Form 8300 And Cash Transactions Over 10 000 Youtube

Form 8300 And Cash Transactions Over 10 000 Youtube Form 8300 relates to cash transactions of over $10,000, and applies to both goods and services. in this video, gary provides insight on who should be concern. When you have a $10,000 cash transaction for your business, you must report it on form 8300. the new law is to e file with irs fincen.

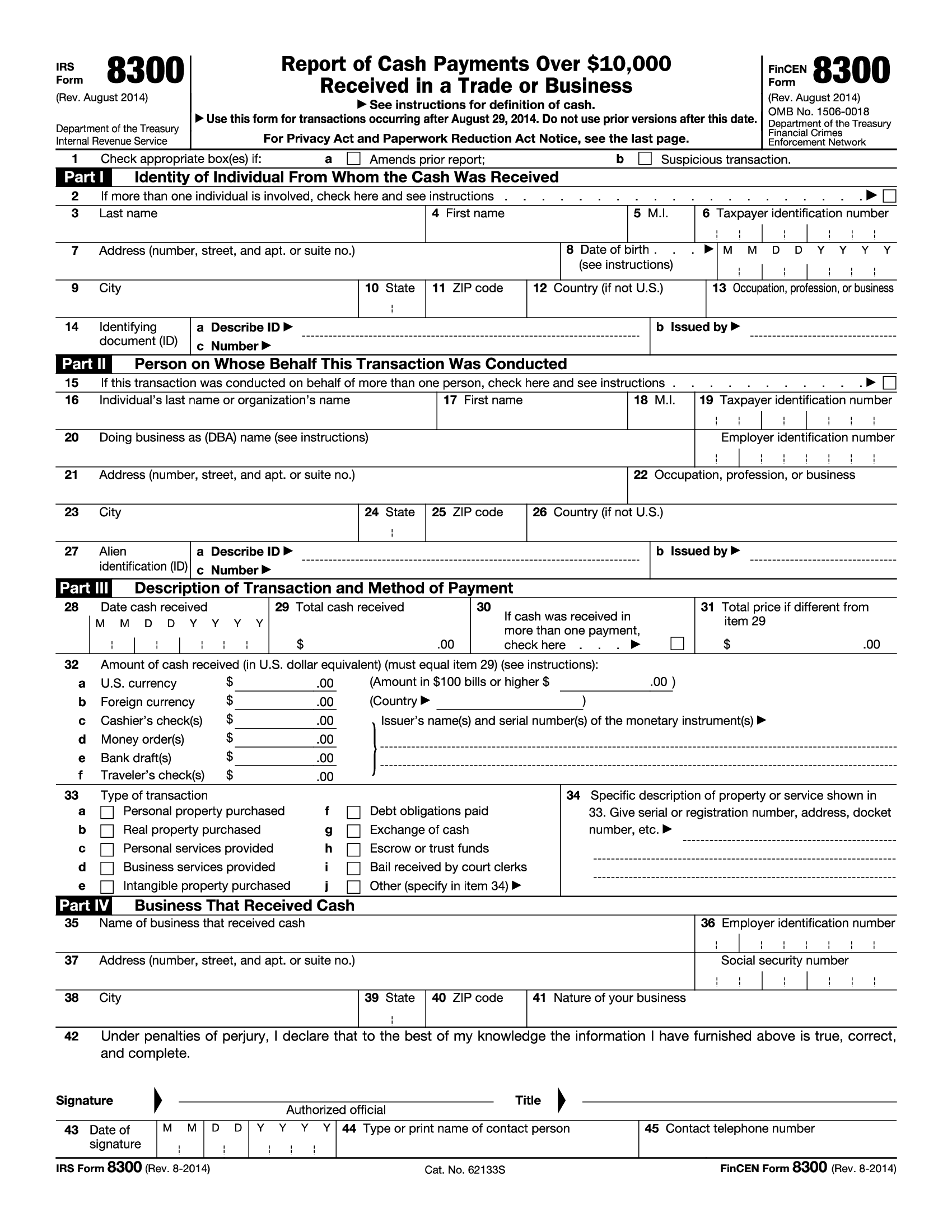

Irs Form 8300 Report Of Cash Payments Over 10 000 Received In A Trade How to report large business cash transactions ($10,000 ) to the irs? how do i report big cash deposits? we explain irs form 8300 for large cash deposits. wa. The form 8300, report of cash payments over $10,000 in a trade or business, provides valuable information to the internal revenue service and the financial crimes enforcement network (fincen) in their efforts to combat money laundering. money is "laundered" to conceal illegal activity, including the crimes that generate the money itself, such. What’s new. starting january 1, 2024, you must electronically file forms 8300, report of cash payments over $10,000 received in a trade or business, if you are required to file certain other information returns electronically (for example, forms 1099 (series), forms w 2, etc.). August 30, 2023. irs form 8300 is the form that businesses use to report the receipt of cash payments over $10,000. it applies to the purchase of both goods and services. generally, businesses must file form 8300 within 15 days after receiving cash payments over $10,000. we recommend that form 8300 be filed online, rather than through the mail.

Comments are closed.