Five Charts Explaining The Global Impact Of Sanctions On Russian Energy

Insight/2022/03.2022/03.11.2022_Charts_Sanctions_Russia_Energy/russia-share-of-global-crude-and-gas-production-new.png)

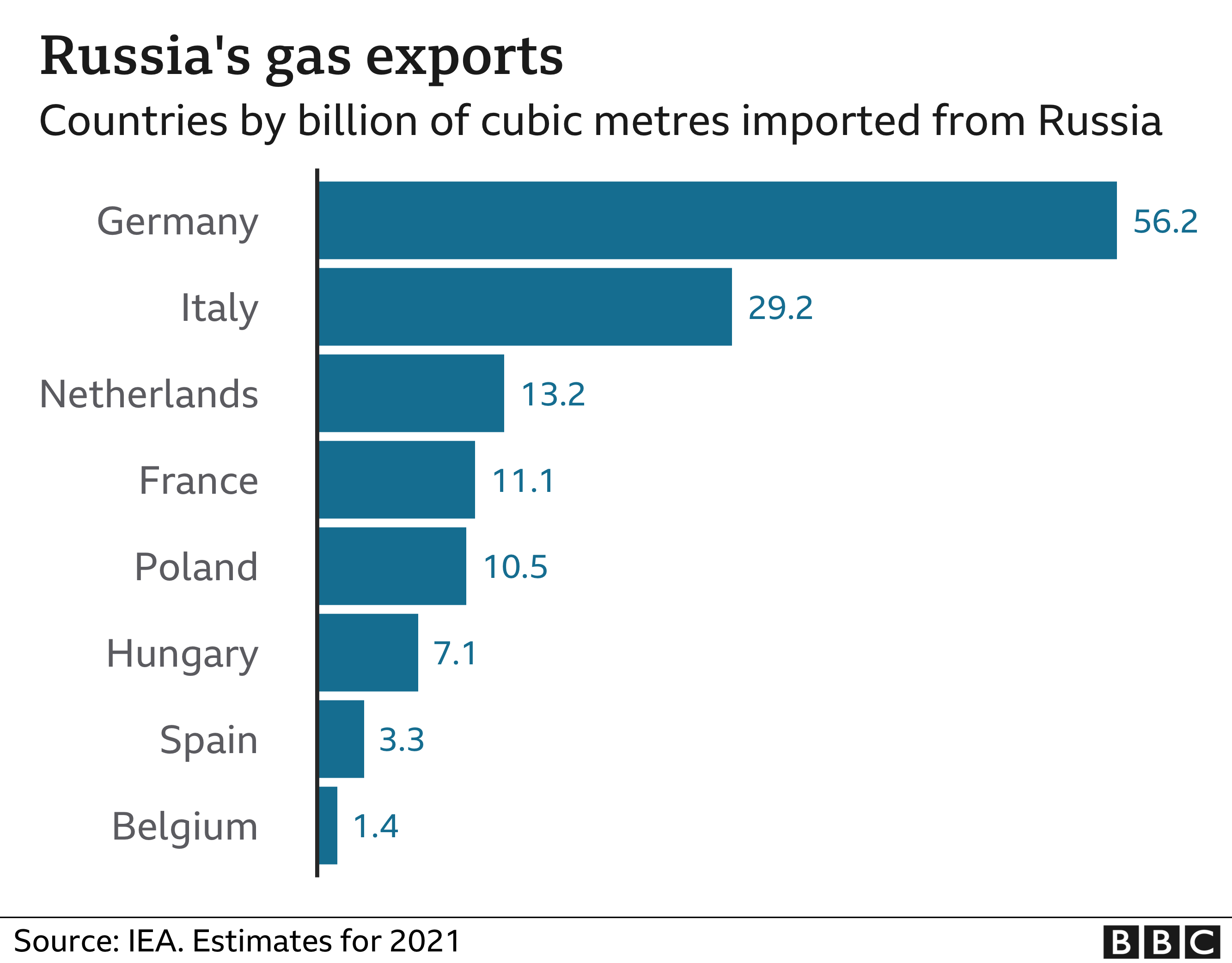

Five Charts Explaining The Global Impact Of Sanctions On Russian Energy By matthew hagerty | march 11, 2022. global energy prices have soared over the last two weeks as events unfolded at the russia ukraine border. one major development has been the economic sanctions imposed on russia and, just this week, the u.s. announced a ban on u.s. imports of russian oil, natural gas, and coal. The u.s. government unsuccessfully opposed this growing dependence. by 2020, russia was supplying 24.9% of the fuel needed by the european union (eu 26), including 38.3% of its natural gas needs (see the first figure below), and energy exports constituted 14% of russia’s gross domestic product in 2021. 1. the european union (eu 26) has relied.

Insight/2022/03.2022/03.11.2022_Charts_Sanctions_Russia_Energy/europe-gas-in-storage.png)

Five Charts Explaining The Global Impact Of Sanctions On Russian Energy This installment of the center for a new american security (cnas) sanctions by the numbers series examines the coercive economic measures, including sanctions, export controls, and price caps, that the united states and european union implemented to curb future revenue from the russian oil, gas, minerals and mining, and nuclear sectors from. When formal sanctions had taken effect in march 2023, russian exports of urals oil traded at an added discount of $32 per barrel relative to brent crude. comparisons of import and export prices of russian crude oil suggest that roughly half of this discount arose from the oil embargo, which segmented the global oil market and forced russia to. How much revenue does russia get from oil and gas now? the sanctions were “aimed at weakening russia’s ability to finance the war.” although it usually takes a long time to see the impact of sanctions, current data demonstrates that restrictive measures are already working. in fact, early results are visible through economic indicators. Impact on russian economy. commodities account for 10% of russian gdp, nearly 70% of goods exports, and more than 20% of government revenue. thus, although russia will benefit from higher commodity prices, its economy is likely to suffer due to financial sanctions. much higher interest rates will have a negative impact on credit market activity.

Russia Sanctions What Impact Have They Had On Its Oil And Gas Exports How much revenue does russia get from oil and gas now? the sanctions were “aimed at weakening russia’s ability to finance the war.” although it usually takes a long time to see the impact of sanctions, current data demonstrates that restrictive measures are already working. in fact, early results are visible through economic indicators. Impact on russian economy. commodities account for 10% of russian gdp, nearly 70% of goods exports, and more than 20% of government revenue. thus, although russia will benefit from higher commodity prices, its economy is likely to suffer due to financial sanctions. much higher interest rates will have a negative impact on credit market activity. As a result of the embargo on russian oil, the volume of russia’s seaborne crude exports to price cap coalition countries dropped by 91% (59.5 mn tonnes) in the 12 months since the sanctions were implemented. while russia made up the deficit in volume terms — exports to non price cap coalition countries rose 67% (65 million tonnes) — they. Russia has long been a relatively minor player in the global economy, accounting for just 1.7 percent of the world’s total output despite its enormous energy exports.

Comments are closed.