Financial Intermediary How It Works Defined Example

:max_bytes(150000):strip_icc()/TermDefinitions_financialintermediary_FINAL-1a577a17254c47a3af54475d755c92dd.png)

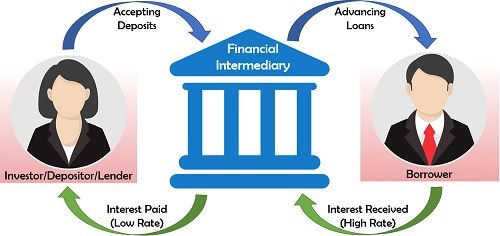

Financial Intermediary What It Means How It Works Examples A financial intermediary refers to an institution that acts as a middleman between two parties in order to facilitate a financial transaction. the institutions that are commonly referred to as financial intermediaries include commercial banks, investment banks, mutual funds, and pension funds. they reallocate uninvested capital to productive. Financial intermediaries move funds from parties with excess capital to parties needing funds. the process creates efficient markets and lowers the cost of conducting business. for example, a.

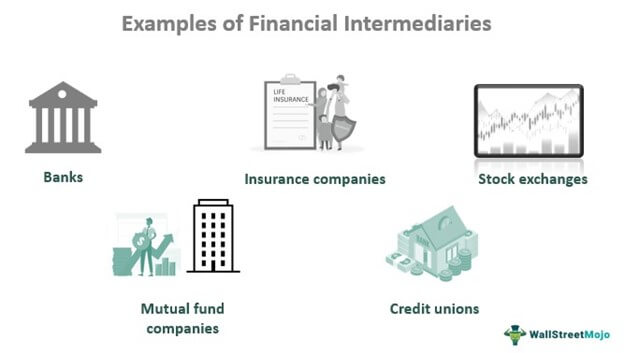

What Are Financial Intermediaries Definition Example Types Financial intermediaries facilitate payments between individuals and businesses through services like online banking, wire transfers, and credit cards. they bridge the gap between savers and borrowers by providing information about investment opportunities and assessing creditworthiness. gathering funds from savers through different investment. Financial intermediary definition. a financial intermediary refers to a third party, forming environment for conducting financial transactions between different parties. for example, the banks accepting deposits from customers and lending them to the customers who need money exemplifies the basic financial intermediation process. 8) clearing houses. clearinghouse acts as a middleman that arranges the final settlement of trade in future markets. clearinghouse provides security and efficiency for financial market stability. it acts as an intermediary between a buyer and seller to ensure the process of trade is smooth. Financial intermediaries: examples. there are numerous companies or institutions that act as financial intermediaries. these include, for example: banks: lending and borrowing money is simplified. stock exchanges: trading in shares and other stock exchange products will be centralised and thus more easily accessible for buyers and sellers.

Financial Intermediary Definition Role Types Examples 8) clearing houses. clearinghouse acts as a middleman that arranges the final settlement of trade in future markets. clearinghouse provides security and efficiency for financial market stability. it acts as an intermediary between a buyer and seller to ensure the process of trade is smooth. Financial intermediaries: examples. there are numerous companies or institutions that act as financial intermediaries. these include, for example: banks: lending and borrowing money is simplified. stock exchanges: trading in shares and other stock exchange products will be centralised and thus more easily accessible for buyers and sellers. Examples of financial intermediaries. 1. insurance companies. if you have a risky investment. you might wish to insure, against the risk of default. rather than trying to find a particular individual to insure you, it is easier to go to an insurance company who can offer insurance and help spread the risk of default. 2. A financial intermediary is an institution that acts as the go between for financial transactions. this could be a bank, pension fund or mutual fund. the term “financial intermediary” is often more commonly used when speaking about lenders and borrowers. the lender has a cash surplus.

Financial Intermediary How It Works Defined Example Examples of financial intermediaries. 1. insurance companies. if you have a risky investment. you might wish to insure, against the risk of default. rather than trying to find a particular individual to insure you, it is easier to go to an insurance company who can offer insurance and help spread the risk of default. 2. A financial intermediary is an institution that acts as the go between for financial transactions. this could be a bank, pension fund or mutual fund. the term “financial intermediary” is often more commonly used when speaking about lenders and borrowers. the lender has a cash surplus.

Comments are closed.