Federal Reserve Hikes But Will It Cut In 2023 Morningstar

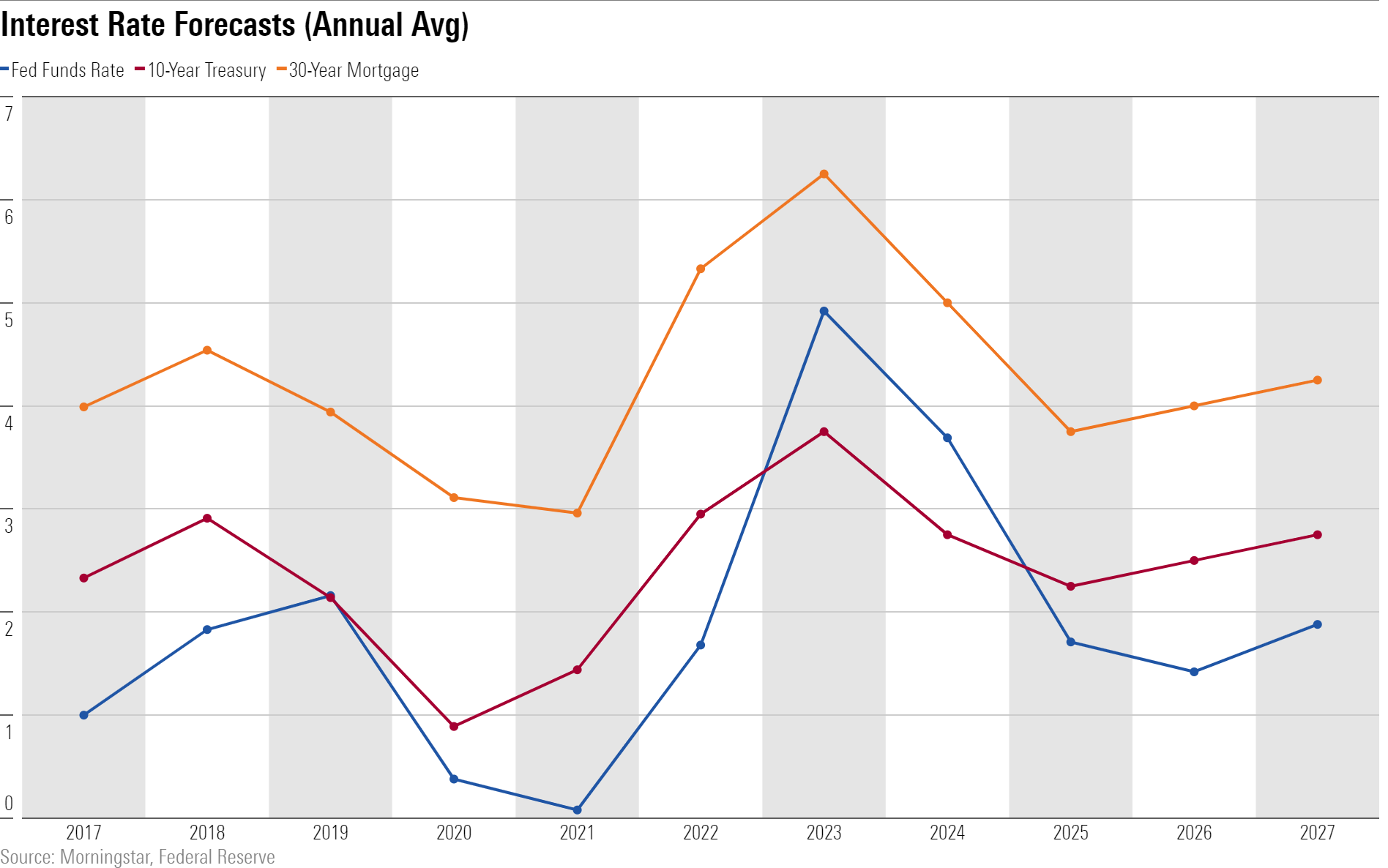

Federal Reserve Hikes But Will It Cut In 2023 Morningstar We expect the fed to cut interest rates in 2023. we expect the fed to pivot to easing monetary policy in 2023 as inflation falls back to the central bank's 2% target and the need to shore up. Since july 2023, the federal reserve has kept the federal funds rate at a target range of 5.25% to 5.50%, far above the near zero levels averaged since the 2008 financial crisis. but we expect fed officials to deliver hefty cuts over the next two years and bring the federal funds rate to 2.00% to 2.

Federal Reserve Hikes But Will It Cut In 2023 Morningstar Additionally, we project 2024 fourth quarter year over year gdp growth of 1.0%, compared with the 1.5% projected by the fed. in our view, this will lead the central bank to cut aggressively in. Sep 17, 2024 4:05am. by peter morici. the challenge: keep interest rates low enough for the u.s. economy to expand, but not so low as to overheat labor markets. just getting close to 2% inflation. Since july 2023, the us federal reserve has kept the federal funds rate at a target range of 5.25% to 5.50%, far above typical levels over the past decade. but we expect fed officials to deliver hefty cuts over the next two to three years and bring the federal funds rate to 1.75% to 2.00% by year end 2026. in our latest economic outlook, we. The federal reserve chose to keep the federal funds rate unchanged at its wednesday meeting, with chair jerome powell emphasizing a cautious approach to additional rate hikes. the federal funds.

Is This The Federal Reserve S Last Rate Hike Morningstar Since july 2023, the us federal reserve has kept the federal funds rate at a target range of 5.25% to 5.50%, far above typical levels over the past decade. but we expect fed officials to deliver hefty cuts over the next two to three years and bring the federal funds rate to 1.75% to 2.00% by year end 2026. in our latest economic outlook, we. The federal reserve chose to keep the federal funds rate unchanged at its wednesday meeting, with chair jerome powell emphasizing a cautious approach to additional rate hikes. the federal funds. The federal reserve is on the verge of cutting interest rates. here's what to know. fed chair jerome powell prepares to deliver remarks at a conference on nov. 8, 2023, in washington, d.c. the fed. The fed said the cut lowers the federal funds rate into a range of 4.75% to 5%, down from its prior range of 5.25% to 5.5%, which had been its highest level in 23 years. the half point move.

Federal Reserve Rate Hikes Will Cause The Great Collapse Of The The federal reserve is on the verge of cutting interest rates. here's what to know. fed chair jerome powell prepares to deliver remarks at a conference on nov. 8, 2023, in washington, d.c. the fed. The fed said the cut lowers the federal funds rate into a range of 4.75% to 5%, down from its prior range of 5.25% to 5.5%, which had been its highest level in 23 years. the half point move.

Stronger Economic Momentum Will Induce More Rate Hikes In 2023

Comments are closed.