Fed Rate Hikes May Drive Up Your Monthly Credit Card Payments Here S

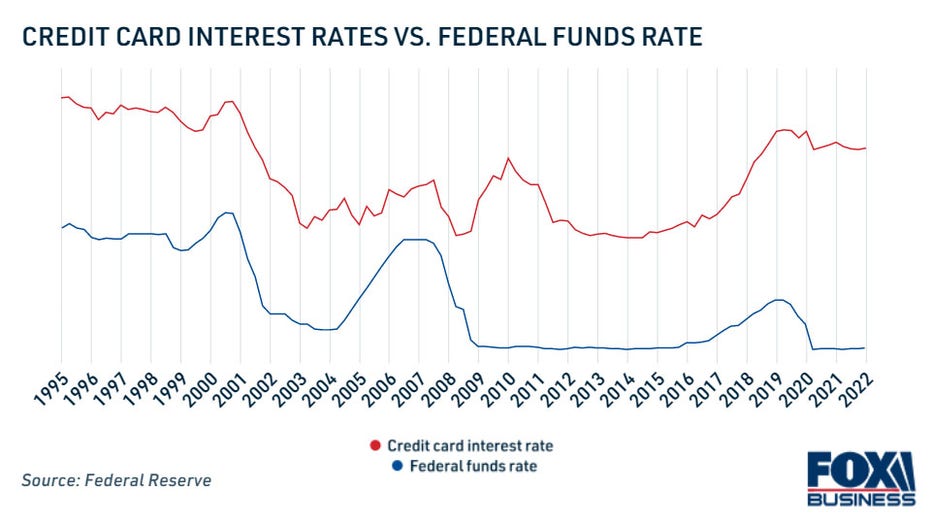

Fed Rate Hikes May Drive Up Your Monthly Credit Card Payments Here S The latest data from the fed shows that the average credit card interest rate has already begun to tick up along with the federal funds rate. in the first quarter of 2022, the average credit card. A single federal reserve funds rate cut will likely only move the needle by 25 basis points. even if, as some experts predict, the fed makes a 50 basis point cut, the federal funds rate will only.

Fed Rate Hikes May Drive Up Your Monthly Credit Card Payments Here S But the fed’s rate is the basis for your bank’s “prime rate.”. in combination with other factors, such as your credit score, the prime rate helps determine the annual percentage rate, or apr, on your credit card. the latest increase will likely raise the apr on your credit card 0.25%. so, if you have a 20.4% rate, which is the average. The most recent fed data has the national average apr for credit cards at 19.07%, up from 14.56% in the first quarter of 2022. "a higher apr on a higher revolving credit card balance could mean. The latest rate increase is smaller than the fed’s half point rate hike in december and its four straight three quarter point increases earlier last year. the slowdown reflects the fact that inflation, while still high, is easing, and some parts of the economy seem to be cooling. but it’s still an increase, to a range of 4.5% to 4.75%. Here’s what that means for your credit cards. two years after it began hiking interest rates from near zero, the federal reserve is keeping its target federal funds rate range at current.

юааfedюаб юааrateюаб юааhikesюаб Can Increase юааyourюаб юааmonthlyюаб юааcreditюаб юааcardюаб юааpa The latest rate increase is smaller than the fed’s half point rate hike in december and its four straight three quarter point increases earlier last year. the slowdown reflects the fact that inflation, while still high, is easing, and some parts of the economy seem to be cooling. but it’s still an increase, to a range of 4.5% to 4.75%. Here’s what that means for your credit cards. two years after it began hiking interest rates from near zero, the federal reserve is keeping its target federal funds rate range at current. In september 2022, the national average rate for a “classic” credit card was 11.64% at credit unions and 13.05% at banks, according to data extracted by the national credit union. In the past few years, the fed kept the federal funds rate near zero, so credit card interest rates have been low. but in 2022, the fed has increased its target rate five times, which has sent the average credit card apr to record levels. the final apr that a credit card issuer offers you will be based on a number of factors, including your.

Fed Rate Hikes And Credit Cards Here S What To Expect Ulink In september 2022, the national average rate for a “classic” credit card was 11.64% at credit unions and 13.05% at banks, according to data extracted by the national credit union. In the past few years, the fed kept the federal funds rate near zero, so credit card interest rates have been low. but in 2022, the fed has increased its target rate five times, which has sent the average credit card apr to record levels. the final apr that a credit card issuer offers you will be based on a number of factors, including your.

Comments are closed.