Fair Credit Billing Act Find 7 Types Of Disputes It Covers

Fair Credit Billing Act Find 7 Types Of Disputes It Covers The fcba of 1974 is a federal law that originated to stop unfair credit billing practices. this act was amended from the truth in lending act.it sets out guidelines available to creditors and consumers to resolve disputes about billing mistakes. Fair credit billing act fcba: the fair credit billing act is a 1974 federal law designed to protect consumers from unfair credit billing practices.

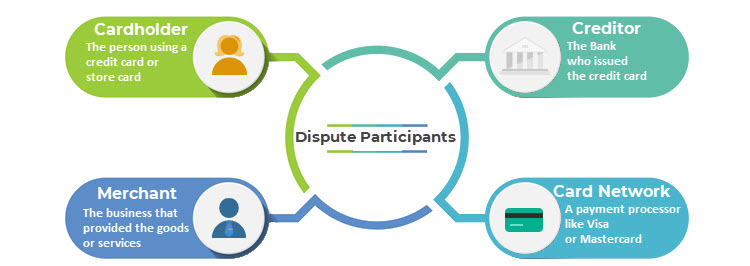

Fair Credit Billing Act Fcba What Is It Examples Rules This act, amending the truth in lending act, requires prompt written acknowledgment of consumer billing complaints and investigation of billing errors by creditors. the amendment prohibits creditors from taking actions that adversely affect the consumer's credit standing until an investigation is completed, and affords other protection during. In 1974, congress passed the fair credit billing act (fcba), designed to protect consumers from unfair billing practices and limit their liability. the fcba gives you the legal right to address. The act covers three main areas where consumers have express rights: limiting liability of unauthorized or inaccurate purchases. withholding payment while disputes are being investigated. timeliness on behalf of creditors regarding billing. today, we'll give an overview of your rights in each of those scenarios. The fair credit billing act (fcba) outlines consumers’ rights to dispute unauthorized charges, charges with errors and undelivered goods or services. the fair credit billing act is an amendment to the truth in lending act, which requires lenders to provide consumers with information about their rates so that borrowers can compare credit offers.

What Is The Fair Credit Billing Act Lexington Law The act covers three main areas where consumers have express rights: limiting liability of unauthorized or inaccurate purchases. withholding payment while disputes are being investigated. timeliness on behalf of creditors regarding billing. today, we'll give an overview of your rights in each of those scenarios. The fair credit billing act (fcba) outlines consumers’ rights to dispute unauthorized charges, charges with errors and undelivered goods or services. the fair credit billing act is an amendment to the truth in lending act, which requires lenders to provide consumers with information about their rates so that borrowers can compare credit offers. The fair credit billing act of 1974 implements required billing practices for “open end credit” like credit cards. the act requires creditors to give consumers 60 days to challenge certain disputed charges over $50 such as wrong amounts, inaccurate statements, undelivered or unacceptable goods, and transactions by unauthorized users. also. The fair credit billing act (fcba) is a united states federal law passed during the 93rd united states congress and enacted on october 28, 1974 as an amendment to the truth in lending act (codified at 15 u.s.c. § 1601 et seq.) and as the third title of the same bill signed into law by president gerald ford that also enacted the equal credit opportunity act.

The Fair Credit Billing Act Explained Ccbill Blog The fair credit billing act of 1974 implements required billing practices for “open end credit” like credit cards. the act requires creditors to give consumers 60 days to challenge certain disputed charges over $50 such as wrong amounts, inaccurate statements, undelivered or unacceptable goods, and transactions by unauthorized users. also. The fair credit billing act (fcba) is a united states federal law passed during the 93rd united states congress and enacted on october 28, 1974 as an amendment to the truth in lending act (codified at 15 u.s.c. § 1601 et seq.) and as the third title of the same bill signed into law by president gerald ford that also enacted the equal credit opportunity act.

The Fair Credit Billing Act Explained Ccbill Blog

Comments are closed.