Different Types Of Mutual Funds To Invest In A Beginner S Guide

Different Types Of Mutual Funds To Invest In A Beginner S Guide These funds can hold assets like bonds, stocks, commodities or a combination of several asset classes. you’ll want to do your research before investing in a fund and make sure you understand the. A mutual fund is an investment that pools together a large amount of money from investors to purchase a basket of securities like stocks or bonds. by purchasing shares of a mutual fund you are.

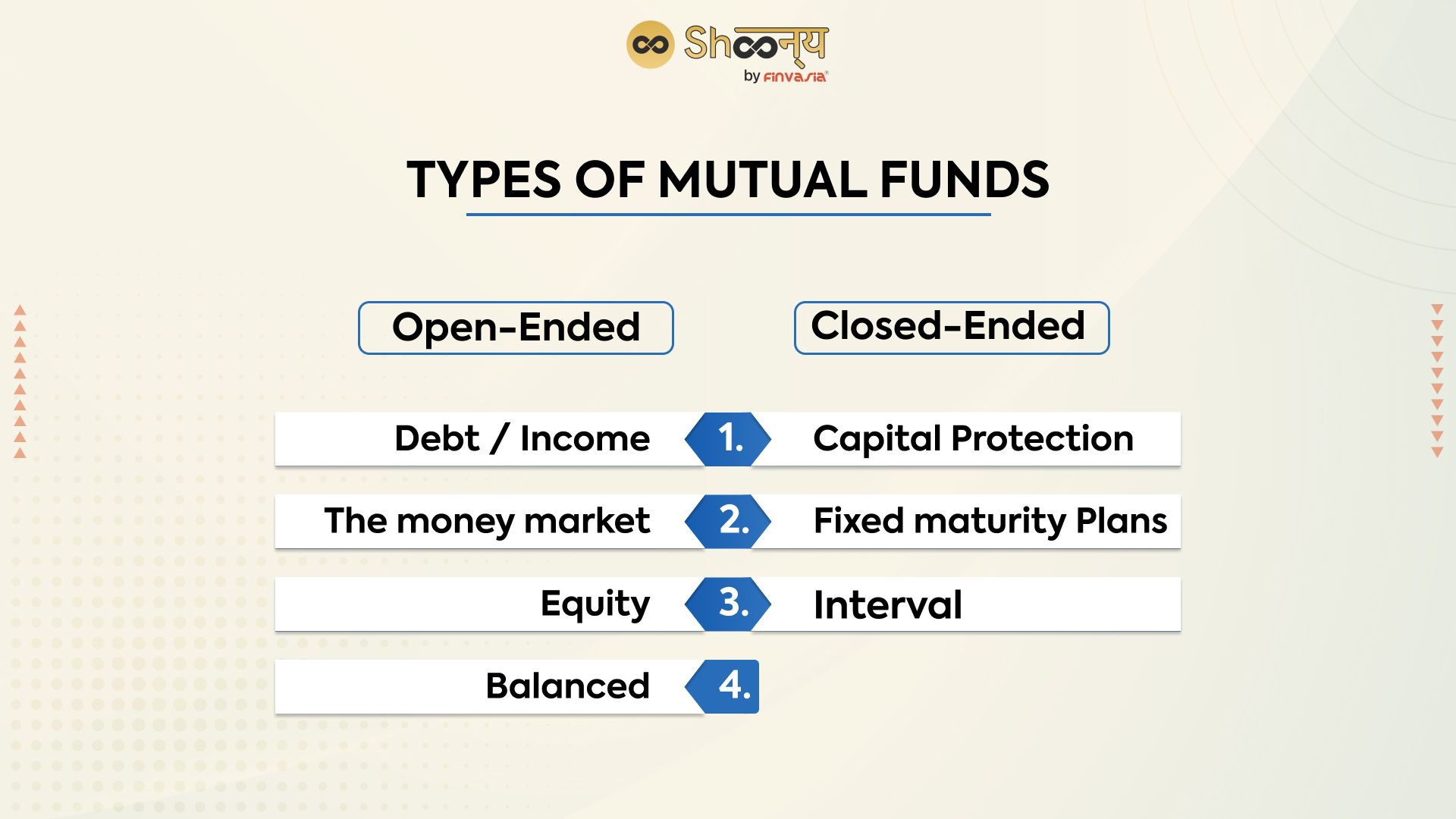

A Beginner S Guide To Understand Mutual Fund Basics Shoonya Blog Minimum investment: while some mutual funds do not have a minimum investment to start investing, some do. the upfront investment could be $100, $1,000, or more. the upfront investment could be. A mutual fund is a portfolio of investments that pools money from investors to purchase multiple securities. some mutual funds are actively managed with the aim to outperform the market. mutual. Here are seven types of mutual funds you’ll encounter when researching assets. 1. equity funds. equity funds invest in stocks, but the composition depends on the individual fund's objectives and goals. for example, value funds hold low p e stocks, while growth funds hold stocks with solid revenue and earnings growth. For most investors, mutual funds are a great way to build a diversified portfolio without a lot of extra cost or hassle. they typically own hundreds if not thousands of different stocks, bonds and.

A Guide To Investing In Mutual Funds Here are seven types of mutual funds you’ll encounter when researching assets. 1. equity funds. equity funds invest in stocks, but the composition depends on the individual fund's objectives and goals. for example, value funds hold low p e stocks, while growth funds hold stocks with solid revenue and earnings growth. For most investors, mutual funds are a great way to build a diversified portfolio without a lot of extra cost or hassle. they typically own hundreds if not thousands of different stocks, bonds and. Mutual funds a type of investment that pools together money from many investors, then uses that money to mutually invest in stocks, bonds or other assets. mutual funds are typically managed by a. Mutual funds 101. it is first important to understand what mutual funds are. mutual funds are a pot of money contributed by different investors and are managed by an individual or group. funds and other investment instruments are divided into shares. shares are a portion of the fund itself.

A Beginner S Guide To Mutual Funds Niit Mutual funds a type of investment that pools together money from many investors, then uses that money to mutually invest in stocks, bonds or other assets. mutual funds are typically managed by a. Mutual funds 101. it is first important to understand what mutual funds are. mutual funds are a pot of money contributed by different investors and are managed by an individual or group. funds and other investment instruments are divided into shares. shares are a portion of the fund itself.

How To Invest In Mutual Funds A Beginner S Guide

Comments are closed.