Decoded Why Central Banks Hike Interest Rates To Tame Inflati

Central Banks Hike Interest Rates In Sync To Tame Inflationођ The federal reserve cut its benchmark interest rate by an unusually large half point, a dramatic shift after more than two years of high rates helped tame inflation but that also made borrowing painfully expensive for consumers. the rate cut, the fed’s first in more than four years, reflects its new focus on bolstering the job market. The us federal reserve on wednesday raised its interest rates by 25 basis points to a range of 5.25 5.50 per cent, the highest in 22 years. across the atlantic, the european central bank, which regulates the euro zone, also raised its rates by 25 basis points to 3.75 per cent, the highest level since 2000 01.

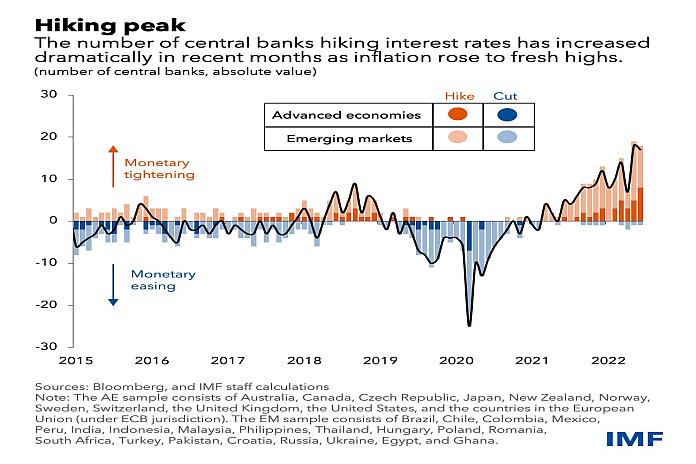

Decoded Why Central Banks Hike Interest Rates To Tameођ As our chart of the week shows, central banks in many emerging markets proactively started to hike rates earlier last year, followed by their counterparts in advanced economies in the final months of 2021. the monetary policy cycle is now increasingly synchronized around the world. importantly, the pace of tightening is accelerating in several. The fed on wednesday lowered its benchmark rate by 0.50 percentage points, a critical pivot after the central bank introduced a flurry of rate hikes to tame the pandemic's high inflation. After sharp rate hikes in 2022 and 2023 to fight inflation, the fed’s benchmark interest rate remains at a 23 year high of 5.25% to 5.5%. many forecasters believe that rate is too high. Published 2:25 pm pdt, may 4, 2022. washington (ap) — the federal reserve intensified its fight against the worst inflation in 40 years by raising its benchmark interest rate by a half percentage point wednesday — its most aggressive move since 2000 — and signaling further large rate hikes to come.

Can Central Banks Policies Tame Inflation Visual Content After sharp rate hikes in 2022 and 2023 to fight inflation, the fed’s benchmark interest rate remains at a 23 year high of 5.25% to 5.5%. many forecasters believe that rate is too high. Published 2:25 pm pdt, may 4, 2022. washington (ap) — the federal reserve intensified its fight against the worst inflation in 40 years by raising its benchmark interest rate by a half percentage point wednesday — its most aggressive move since 2000 — and signaling further large rate hikes to come. As our chart of the week shows, central banks in many emerging markets proactively started to hike rates earlier last year, followed by their counterparts in advanced economies in the final months of 2021. a graph showing the number of central banks hiking interest rate has increased in recent months. image: imf. Central banks should hold interest rates at their current high levels or raise them further to defeat inflation, the oecd said, despite “increasingly visible” signs of economic strains and.

Why Central Banks Hike Rates To Tame Inflation World Busin As our chart of the week shows, central banks in many emerging markets proactively started to hike rates earlier last year, followed by their counterparts in advanced economies in the final months of 2021. a graph showing the number of central banks hiking interest rate has increased in recent months. image: imf. Central banks should hold interest rates at their current high levels or raise them further to defeat inflation, the oecd said, despite “increasingly visible” signs of economic strains and.

Can Central Banks Policies Tame Inflation Visual Content

Comments are closed.