Credit Unions Vs Banks What S The Difference Thestreet

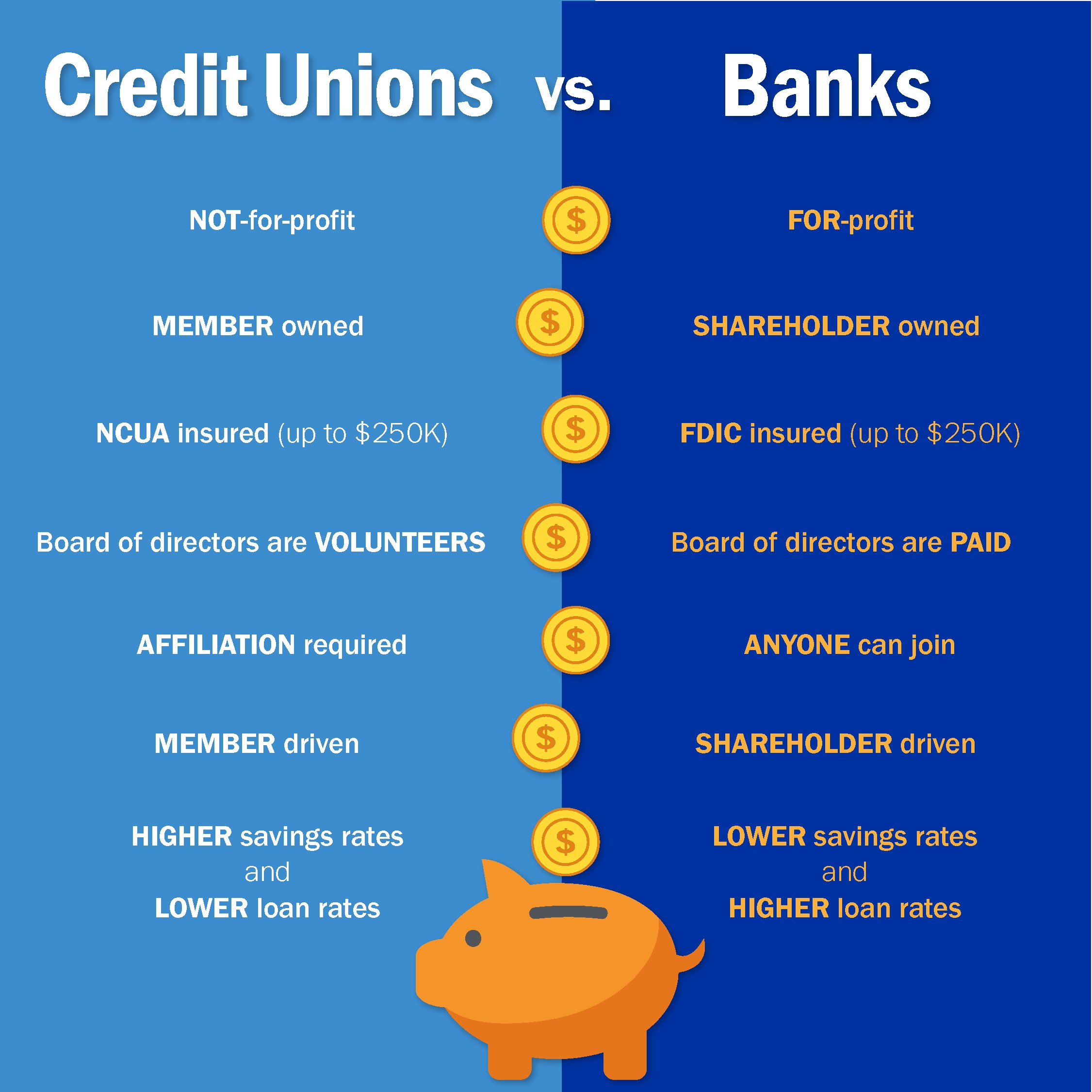

Credit Unions Vs Banks What S The Difference Thestreet Savingssavingssavings. taxestaxestaxes. when deciding between a bank and a credit union, it is important to consider which works best for your particular financial needs. the overall differences. Better rates on savings accounts and loans: credit unions offer higher interest rates on savings accounts and lower rates on loans—exactly what consumers want. higher interest rates on bank.

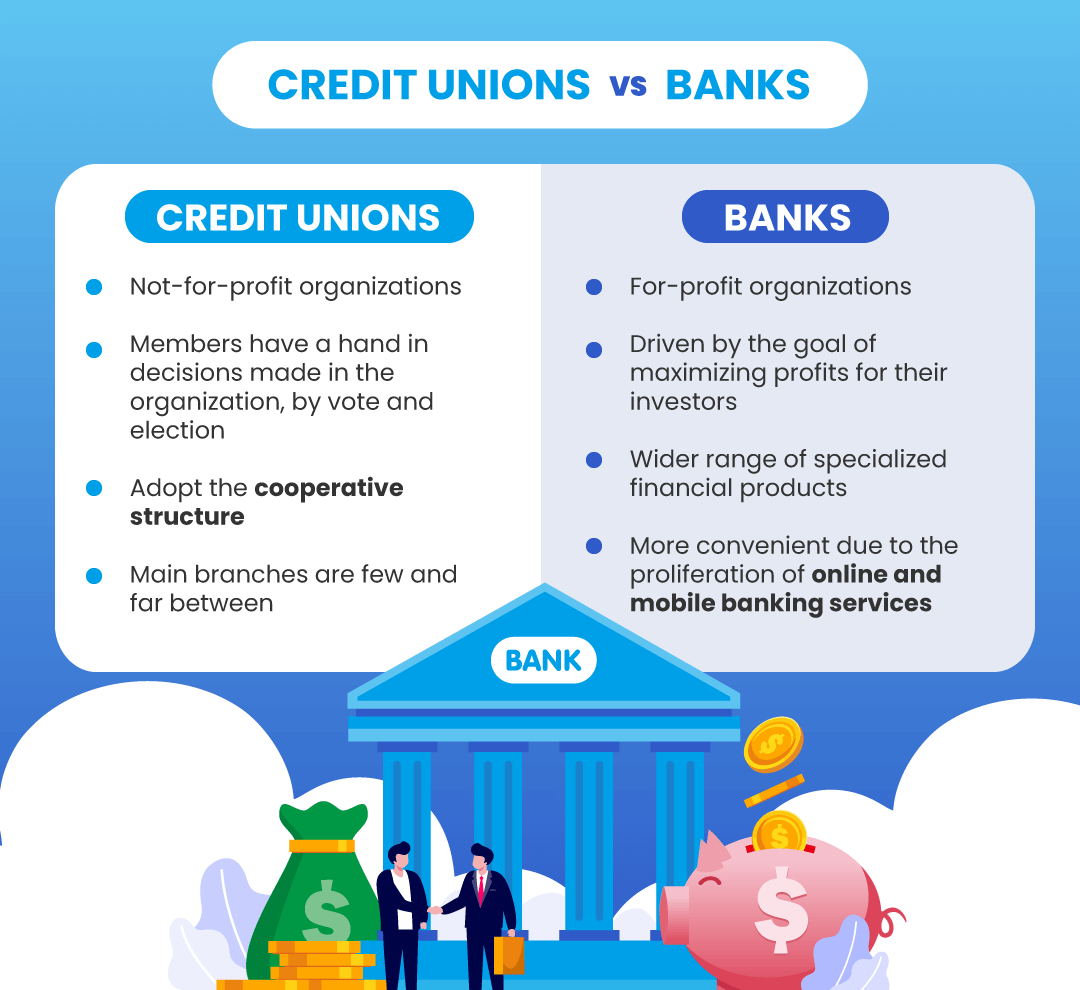

Credit Unions And Banks The Differences The main difference between a credit union and a bank is that credit unions are not for profit, whereas banks are for profit enterprises. knowing about the other differences will affect which home. Average credit union vs. bank fees ; credit union: bank average share draft checking nsf fee $23.86: $31.24: average credit card late fee: $24.56: $34.18: average mortgage closing costs: $1,151. Cons. customer service: banks tend to get lower marks for customer service than credit unions, though it’s more of a problem at big banks than smaller ones. lower savings rates: because banks. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022.

Credit Union Vs Bank What Are The Differences Azeus Convene Cons. customer service: banks tend to get lower marks for customer service than credit unions, though it’s more of a problem at big banks than smaller ones. lower savings rates: because banks. Alliant credit union, ally bank and capital one are just a few of the financial institutions that have been at the forefront of this trend. the average overdraft fee decreased 11 percent from 2022. The key difference between a credit union vs. bank is that credit unions are nonprofits while banks are for profit institutions. as a result, credit unions can offer lower loan rates and higher. Lower savings rates. banks generally are less competitive than credit unions in terms of interest rates for savings accounts. for instance, as of march 31, 2023, the national average rate for a.

Comments are closed.