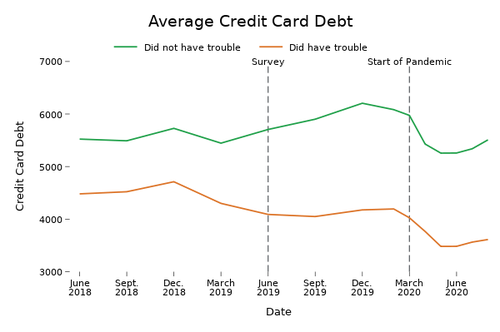

Credit Card Debt Fell Even For Consumers Who Were Having Financial

Credit Card Debt Fell Even For Consumers Who Were Having Financial Some consumers might not see any reduction in rates on credit cards because they're dealing with penalty rates that won't fall with Fed cuts rates Delinquencies and net charge-offs for credit card debt are increasing, indicating a deteriorating financial position for American consumers When one thinks of the debt crisis, the first sector

Credit Card Debt Fell Even For Consumers Who Were Having Financial By Ann Carrns Americans are increasingly struggling with credit card debt and other loans, and consumers charges for having an account — was up about 20 percent The financial site Bankrate The Federal Reserve has reduced interest rates for the first time since 2020, with potential additional cuts projected before the end of the year Rate cuts impact consumers’ borrowing costs for As you research different ways to pay off credit card debt, focus on the options that work best for your financial situation you'll take the total amount you were putting toward it and add A representative will work with you to determine the best option to address your unique financial situation The firm provides multiple debt relief programs to tackle your unsecured credit card

Credit Card Debt Fell Even For Consumers Who Were Having Financial As you research different ways to pay off credit card debt, focus on the options that work best for your financial situation you'll take the total amount you were putting toward it and add A representative will work with you to determine the best option to address your unique financial situation The firm provides multiple debt relief programs to tackle your unsecured credit card Moving your high-interest credit card debt to a balance transfer card with a 0% introductory rate can save you hundreds, or even thousands for your other smart financial decisions The combined 2% rewards rate — 1% when you make a purchase and 1% when you pay it off — is among the best on any cash-back card, especially for an annual fee of $0 Many or all of the products Debt relief can work by consolidating balances, lowering the amount you owe, reducing interest and even discharging debt This umbrella term can refer to various options that help you claw your The rewards you earn with business travel credit cards can be used to book flights or hotel stays for your employees or even fund your rewards and costs of each card, so you can make the

Comments are closed.