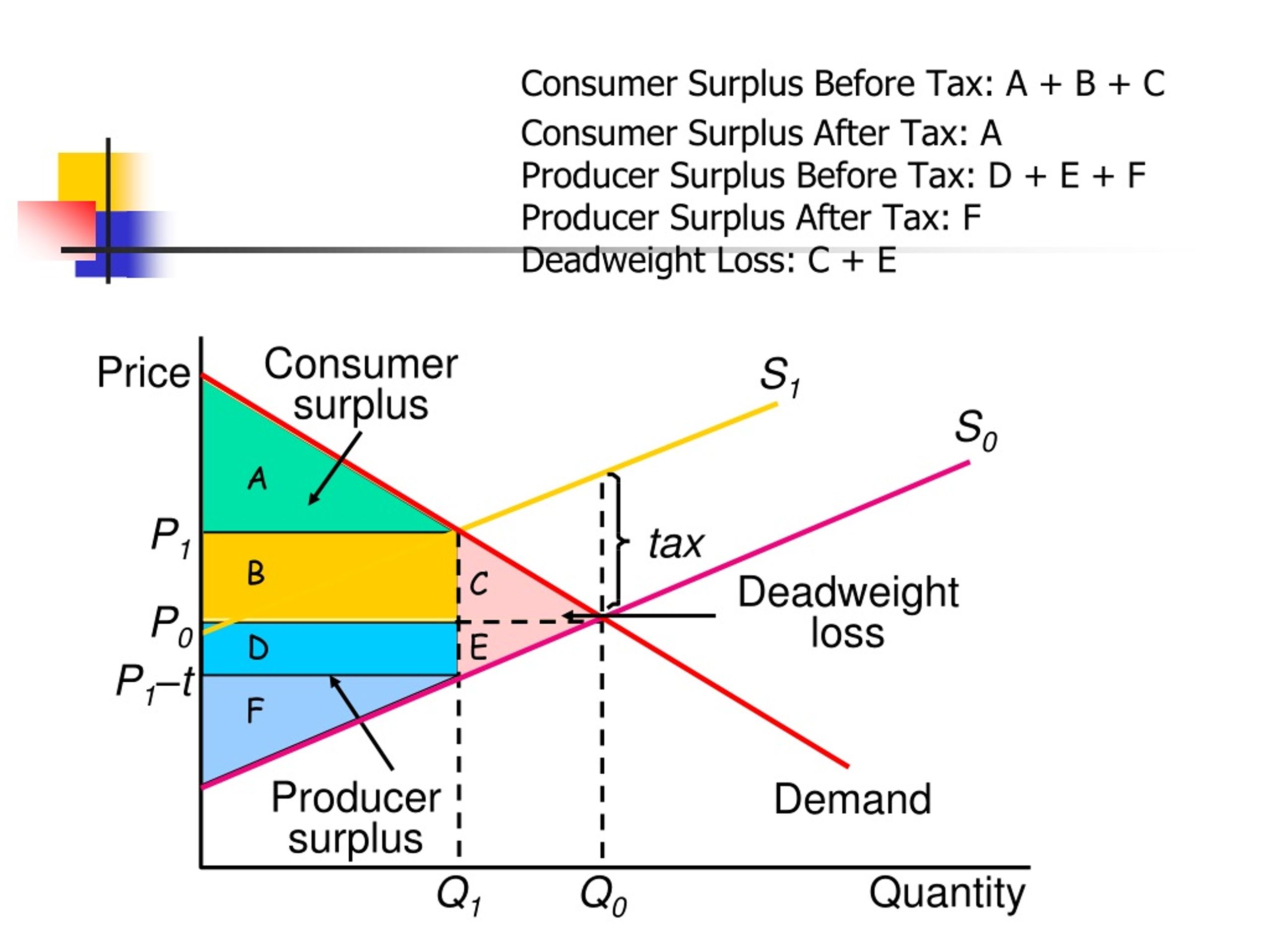

Consumer Surplus After Tax

Ppt Taxes Powerpoint Presentation Free Download Id 3770416 The first wedge tested is only $0.7, followed by $1.5, until the $3.0 tax is found. figure 4.7c. market surplus. like with price and quantity controls, one must compare the market surplus before and after a price change to fully understand the effects of a tax policy on surplus. figure 4.7d. In our earlier example with the television, we can see that consumer surplus equals $1,300 minus $950 to give us a total of $350 for our surplus. on a larger scale, we can use an extended consumer surplus formula: consumer surplus = (½) x qd x Δp. qd = the quantity at equilibrium where supply and demand are equal. Δp = pmax – pd.

Ppt Taxation Powerpoint Presentation Free Download Id 79797 An indirect tax is a tax imposed by the government that increases the supply costs of producers. the amount of the tax is always shown by the vertical distance between the pre and post tax supply curves. because of the tax, less can be supplied to the market at each price level. consumer surplus. consumer surplus is the difference between the. A price ceiling is imposed at $400, so firms in the market now produce only a quantity of 15,000. as a result, the new consumer surplus is t v, while the new producer surplus is x. (b) the original equilibrium is $8 at a quantity of 1,800. consumer surplus is g h j, and producer surplus is i k. Consumer and producer surpluses are shown as the area where consumers would have been willing to pay a higher price for a good or the price where producers would have been willing to sell a good. in the sample market shown in the graph, equilibrium price is $10 and equilibrium quantity is 3 units. the consumer surplus area is highlighted above. Consumer surplus, also known as buyer’s surplus, is the economic measure of a customer’s excess benefit. it is calculated by analyzing the difference between the consumer’s willingness to pay for a product and the actual price they pay, also known as the equilibrium price. a surplus occurs when the consumer’s willingness to pay for a.

Comments are closed.