Consumer Spending Up 0 4 In May But Personal Income Gains Just 0 2

Consumer Spending Up 0 4 In May But Personal Income Consumer spending edges up 0.1% in may; core pce price index rises 0.3%; up 4.6% year on year; personal income increases 0.4%; saving rate rises to 4.6% with job gains, housing starts, orders. Consumer spending continues to show signs of stress as many wait for the impact of the boc rate cuts to filter through to mortgage interest costs. interest rates are still high. canadians renewing fixed rate mortgages in 2024 still face significantly higher rates, which will cut into broader purchasing power.

Consumer Spending Tutor2u Economics Pce price index flat in may; up 2.6% on year on year basis; core pce edges up 0.1%; rises 2.6% on year on year basis; consumer spending gains 0.2%; personal income up 0.5% is just what the. Personal outlays —the sum of pce, personal interest payments, and personal current transfer payments—increased $56.4 billion in may (table 2). personal saving was $806.1 billion in may and the personal saving rate —personal saving as a percentage of disposable personal income—was 3.9 percent (table 1). prices. Stocks: u.s. stock futures were little changed after the report, up 0.3% bonds: benchmark 10 year yields were down three basis points to about 4.27%; two year yields fell four points to 4.69%. Consumer spending on services to rise 3.1% in 2023. given these headwinds and tailwinds, we expect overall consumer spending growth to slow to 1.9% in 2023 from 2.8% in 2022; growth is expected to remain almost the same next year. 13 much of this growth will be due to services—we forecast pce on services to rise 3.1% this year and 4.7% in 2024.

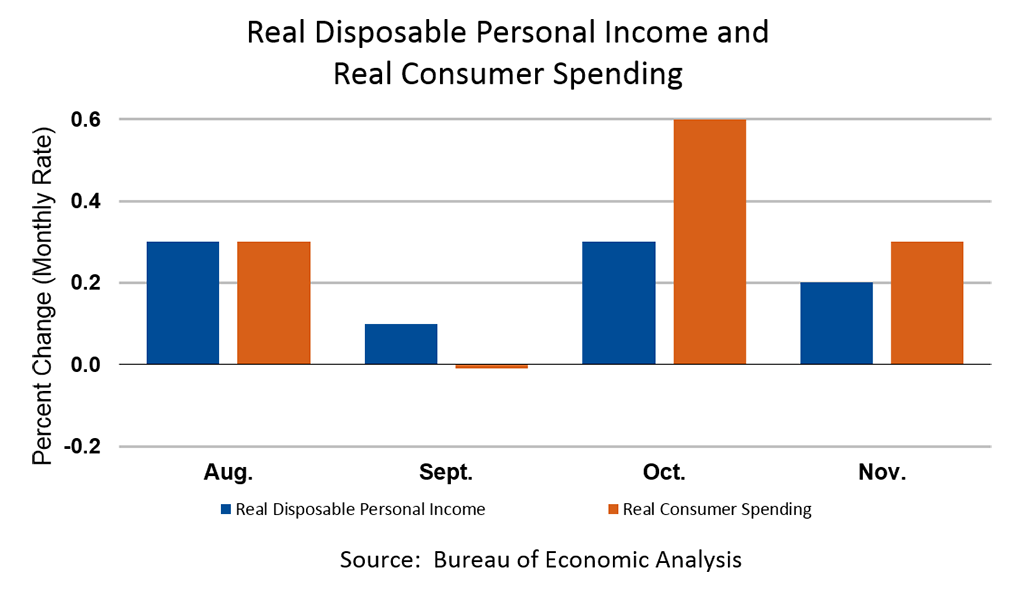

Consumer Spending Economics Tutor2u Stocks: u.s. stock futures were little changed after the report, up 0.3% bonds: benchmark 10 year yields were down three basis points to about 4.27%; two year yields fell four points to 4.69%. Consumer spending on services to rise 3.1% in 2023. given these headwinds and tailwinds, we expect overall consumer spending growth to slow to 1.9% in 2023 from 2.8% in 2022; growth is expected to remain almost the same next year. 13 much of this growth will be due to services—we forecast pce on services to rise 3.1% this year and 4.7% in 2024. July 2024. 0.3%. june 2024. 0.2%. personal income increased $75.1 billion (0.3 percent at a monthly rate) in july. disposable personal income (dpi)—personal income less personal current taxes—increased $54.8 billion (0.3 percent). personal outlays—the sum of personal consumption expenditures (pce), personal interest payments, and. Personal income increased $57.1 billion (0.2 percent at a monthly rate) in october, according to estimates released today by the bureau of economic analysis (tables 2 and 3). disposable personal income (dpi), personal income less personal current taxes, increased $63.4 billion (0.3 percent) and personal consumption expenditures (pce) increased $41.2 billion (0.2 percent).

Personal Income U S Bureau Of Economic Analysis Bea July 2024. 0.3%. june 2024. 0.2%. personal income increased $75.1 billion (0.3 percent at a monthly rate) in july. disposable personal income (dpi)—personal income less personal current taxes—increased $54.8 billion (0.3 percent). personal outlays—the sum of personal consumption expenditures (pce), personal interest payments, and. Personal income increased $57.1 billion (0.2 percent at a monthly rate) in october, according to estimates released today by the bureau of economic analysis (tables 2 and 3). disposable personal income (dpi), personal income less personal current taxes, increased $63.4 billion (0.3 percent) and personal consumption expenditures (pce) increased $41.2 billion (0.2 percent).

Consumer Spending U S Bureau Of Economic Analysis Bea

Comments are closed.