Consumer Payment History Archives Centrix

Consumer Payment History Archives Centrix Consumer payment history . consumer credit reports explained centrix delivers financial data win for business, media releases, news . are kiwi households. Centrix consumer reports include the following information: consumer information; the report contains any unique information a potential creditor or employer might need to identify you, such as your name, address, and date of birth. if you have gone by previous names, or listed other addresses on your financial records, these are also shown.

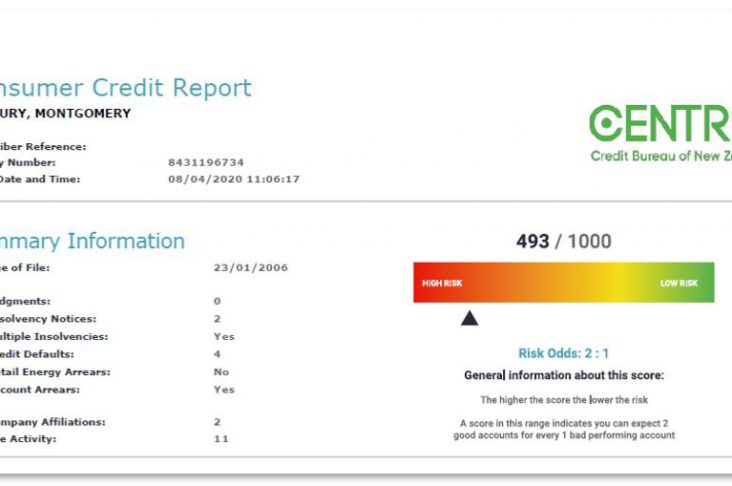

Customer Credit Risk Credit Risk Analysis Centrix Payment history shows how you've paid your accounts over the length of your credit. this evidence of repayment is the primary reason why payment history makes up 35% of your score and is a major factor in its calculation. research shows that your track record of payment tends to be the strongest predictor of the likelihood that you'll pay all. A credit score represents your creditworthiness – the higher the score, the better you look to lenders. typically shown as a number out of 1000, your score is on a file held by credit reporting agencies such as centrix, equifax and illion. every time a company runs a credit check about you, it goes on the file. Getty. payment history is the record of a borrower’s payments on their credit accounts and other debts. as the most important factor when calculating a consumer’s credit score, payment history. In a nutshell. your payment history on your credit reports is just that: a history of your payments to lenders. it shows if you’ve paid your bills on time and it's an important part of your credit scores, so it’s good to know how your payment history is determined. editorial note: intuit credit karma receives compensation from third party.

Comments are closed.