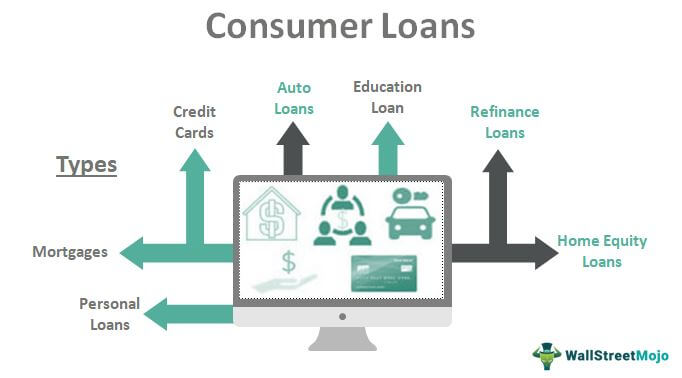

Consumer Loan What Is It Examples Types Interest Eligibility

Consumer Loan What Is It Examples Types Interest Eligibility The minimum eligibility to apply for a consumer loan is 21, and the maximum can go up to 60 years of age. if one is salaried, the maximum age limit is 60 years. however, if some are self employed professionals, they can go till 65 years of age. also, this depends on bank to bank, and factors such as credit score are also considered. A high credit score makes you a less risky borrower and may allow you to borrow more money at a cheaper interest rate. interest rate on consumer loans in the usa: personal loans = 5% ~ 36% (depending on credit score) education loans = 4.5% ~ 6%. credit card = 13% ~ 16%. house loan = 3.5% ~ 4%. refinance loan = 3.5% ~ 4%.

Types Of Loans 6 types of personal loans and when they're best. 1. mortgage. a mortgage is a secured loan from a bank to a consumer for buying a house, which usually costs much more than an average person earns in a year. this type of loan is stretched over a longer period to ease out monthly installments, the most common mortgage being a 30 year fixed rate loan. 2. auto loan. You decide how to use the money. one affordable, fixed monthly payment. cash deposited directly into your bank account. 2. balance transfer loans. with a balance transfer loan, you can save money by having the lender pay down your credit cards or other debt directly, on your behalf. Categories of loans. 1. open end loan. an open end consumer loan, also known as revolving credit, is a loan in that the borrower can use for any type of purchases but must pay back a minimum amount of the loan, plus interest, before a specified date. open end loans are generally unsecured. if a consumer is unable to pay off the loan in full.

Comments are closed.