Consumer Directed Health Plans

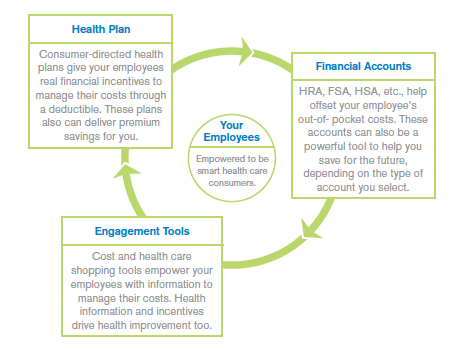

Consumer Directed Health Plans Welcome To Blue Cross Blue Shield Of Learn the differences between consumer directed health plans (cdhps) and preferred provider organizations (ppos) in terms of costs, benefits, and flexibility. cdhps use high deductibles and health savings accounts, while ppos offer more choices but higher premiums and copays. “consumer directed health plans combine financial engagement and comprehensive support to move employees toward becoming empowered consumers of health care services,” bcbs said. “this approach can help your company manage costs over the long term and be an effective strategy for delivering quality, sustainable coverage for your workforce.”.

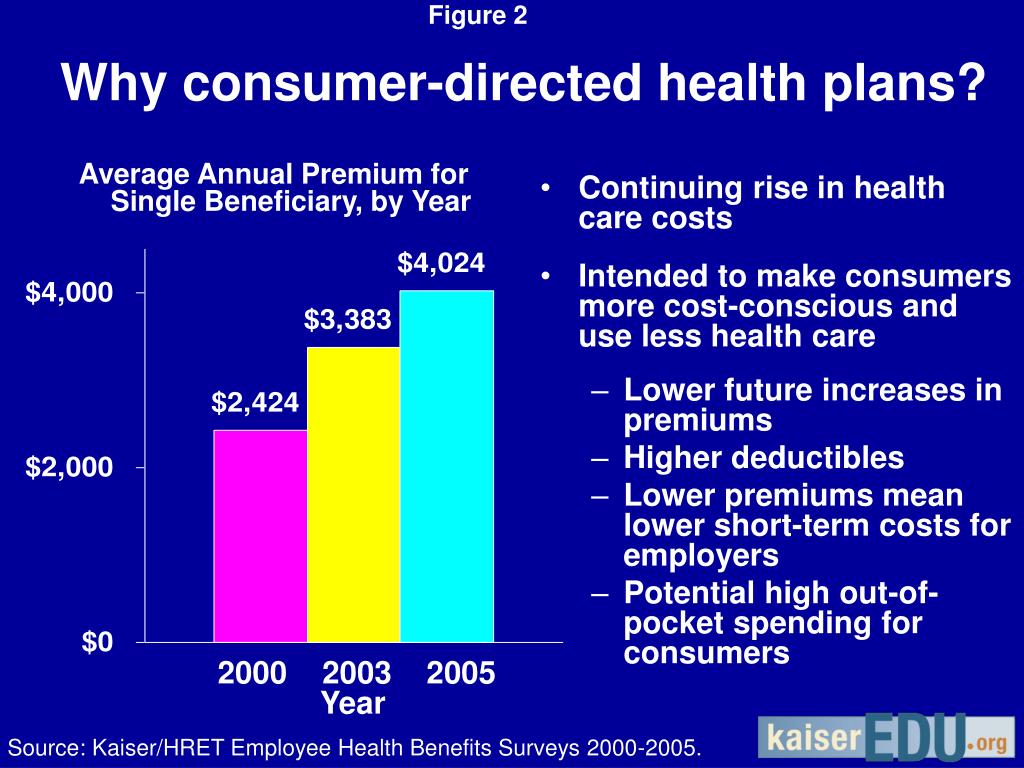

Ppt Consumer Directed Health Plans Powerpoint Presentation Id 20812 Learn what consumer driven health plans (cdhps) are, how they can save employers money and empower employees to make their own healthcare decisions. compare different types of cdhps, such as hsas, hras and fsas, and explore other options like qsehras and ichras. Learn how consumer directed health plans (cdhps) work, who can enroll, and how they save money with health savings accounts (hsas). compare cdhps to other pebb plans and find out the benefits and risks of choosing a cdhp. Consumer driven healthcare (cdhc), or consumer driven health plans (cdhp) refers to a type of health insurance plan that allows employers or employees to utilize pretax money to help pay for medical expenses not covered by their health plan. these plans are linked to health savings accounts (hsas), health reimbursement accounts (hras), or. One plan worth a close look is the consumer directed health plan (cdhp) – sometimes called a consumer driven health plan and high deductible health plan (hdhp). with a cdhp, you must pay your medical costs before your health plan does. here’s an example. with a ppo and an hmo, you typically have a copay when you visit a doctor.

Comments are closed.