Consumer Credit Risk Models

Credit Risk Modelling Download Editable Diagrams Templates Abstract. we apply machine learning techniques to construct nonlinear nonparametric forecasting models of consumer credit risk. by combining customer transactions and credit bureau data from january 2005 to april 2009 for a sample of a major commercial bank’s customers, we are able to construct out of sample forecasts that significantly. Deling, of which our consumer credit risk model is just one of many recent examples.7see, for example, li, shiue, and huang (2006) and bellotti. nd crook (2009) for applications of machine learning based model to consumer credit.one measure of the forecast power of our approach is to compare the machine learning model's forecasted scores of.

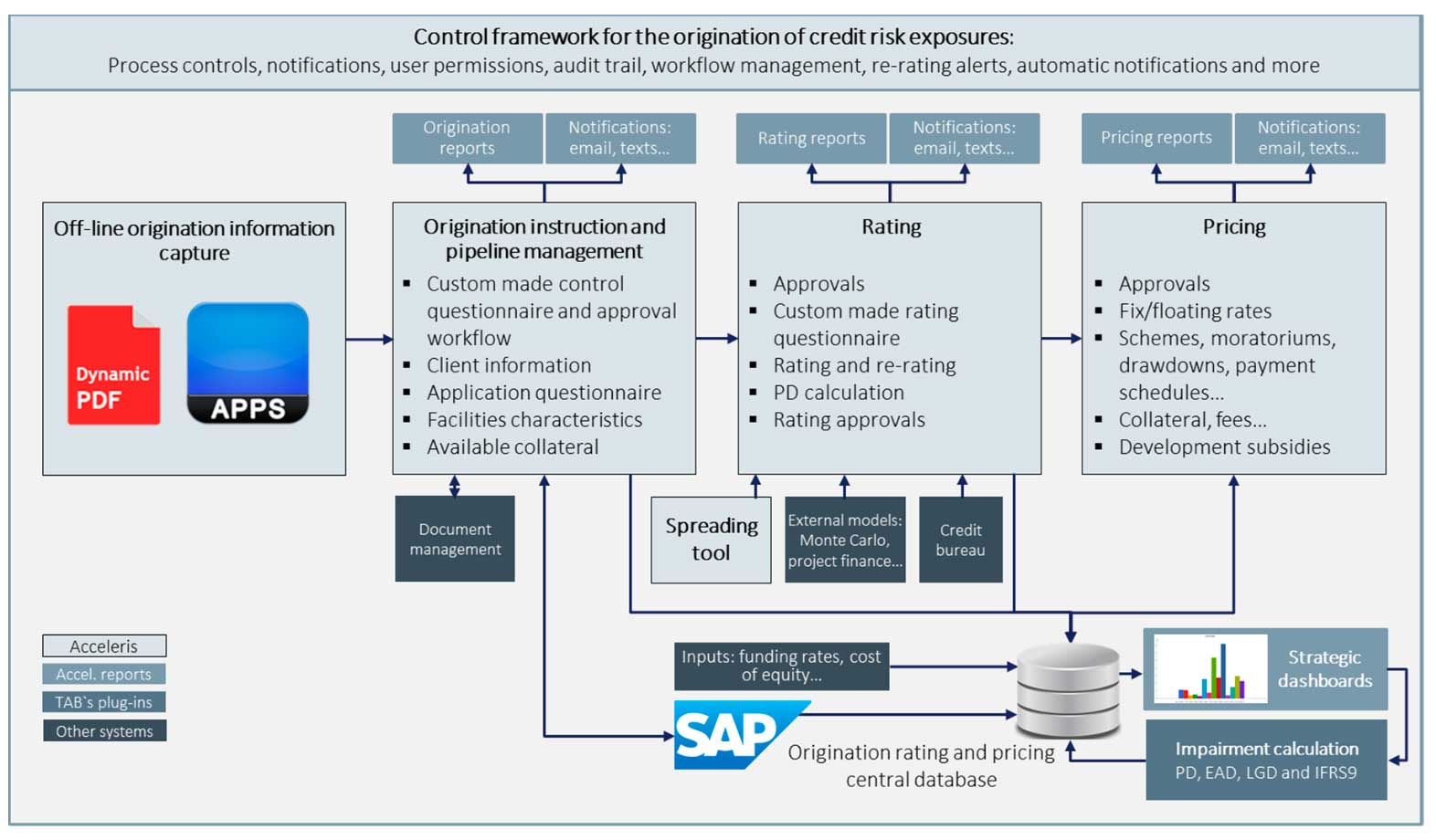

Credit Risk Modelling Tools The Analytics Boutique Explainable machine learning models of consumer credit. This study compares nine credit risk prediction models on consumer loan data of p2p lc platform, divided into two phases: a difficult economic period (2007–2012) and a stage of economic recovery and development (2013–2019). to avoid imbalanced data, the study uses a random undersampling technique and performance metrics for imbalanced data. Four best practices. mckinsey has identified four best practices when designing new credit decisioning models: implement a modular architecture, expand data sources, mine data for credit signals, and leverage business expertise. we have also defined a five stage agile process to implement a new model in less than six months, much faster than. According to table 2, the detailed label information is showed, one main finding is that deep learning and ensemble learning methods are developed for consumer credit risk assessment in recent years. however, neural networks and decision tree models are utilized for consumer credit risk assessment in the early years.

Consumer Credit Risk Models Pdf Credit Card Machine Learning Four best practices. mckinsey has identified four best practices when designing new credit decisioning models: implement a modular architecture, expand data sources, mine data for credit signals, and leverage business expertise. we have also defined a five stage agile process to implement a new model in less than six months, much faster than. According to table 2, the detailed label information is showed, one main finding is that deep learning and ensemble learning methods are developed for consumer credit risk assessment in recent years. however, neural networks and decision tree models are utilized for consumer credit risk assessment in the early years. Explainable machine learning models of consumer credit risk the journal of financial data science, fall 2023, 5 (4) 9 39 doi: 10.3905 jfds.2023.1.141 posted: 14 jan 2022 last revised: 12 apr 2024. Consumer credit risk models via machine learning algorithms. we apply machine learning techniques to construct nonlinear nonparametric forecasting models of consumer credit risk. by combining customer transactions and credit bureau data from january 2005 to april 2009 for a sample of a major commercial bank’s customers, we are able to.

Comments are closed.