Central Banks Opt For Shock And Awe To Tame Inflation

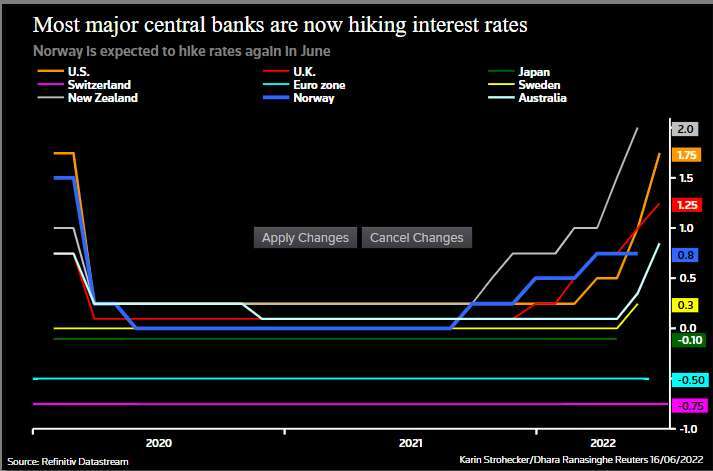

Central Banks Opt For Shock And Awe To Tame Inflation Kitko With inflation at 6.4%, versus its 2% target, the riksbank may now opt for bigger moves . having said as recently as february that rates would not rise until 2024, the riksbank expects to hike two. Graphic central banks opt for shock and awe to tame inflation credit: reuters ralph orlowski. june 16, 2022 — 08:48 am edt. with inflation at 6.4%, versus its 2% target, the riksbank may now.

Central Banks Opt For Shock And Awe To Tame Inflation Kitko It leaves the bank of japan the only major developed world central bank still clinging to the inflation is transitory mantra. the fed is also reducing its $9 trillion stash of assets accumulated. With euro zone inflation hitting 8.6% in june, the european central bank (ecb) will raiseinterest rates by 25 bps on july 21 for the first time since 2011 and again in september read more . London (reuters) the federal reserve this week delivered its biggest interest rate rise in over a quarter of a century and even the swiss national bank took markets by surprise with an aggressive rate hike. it leaves the bank of japan the only major developed world central bank still clinging to. With inflation at 6.4%, versus its 2% target, the riksbank may now opt for bigger moves. having said as recently as february that rates would not rise until 2024, the riksbank expects to hike two.

Central Banks Opt For Shock And Awe To Tame Inflation Asset Digest London (reuters) the federal reserve this week delivered its biggest interest rate rise in over a quarter of a century and even the swiss national bank took markets by surprise with an aggressive rate hike. it leaves the bank of japan the only major developed world central bank still clinging to. With inflation at 6.4%, versus its 2% target, the riksbank may now opt for bigger moves. having said as recently as february that rates would not rise until 2024, the riksbank expects to hike two. Eswar prasad, an economist at cornell university, says friday’s data made declaring victory against inflation “a much more fraught” decision for central banks. “the reality is that, with. June 5, 2023. listen with. speechify. 0:00. 6:24. recent events have shown central banks and policymakers can deal with sizable financial stress without compromising their inflation fighting stance. regulators and central banks were able to contain contagion from the collapse of silicon valley bank and other us regional banks, as well as credit.

Comments are closed.