Businesses Are Returning 140 Million In Surprise Overdraft Fees To

Businesses Are Returning 140 Million In Surprise Overdraft Fe Surprise bank overdraft and nonsufficient fund fees account for $120 million of the amount. nearly two thirds of banks with more than $10 billion in assets have dropped nsf fees, according to a. As a result of the cfpb’s supervisory work, the companies in today’s report are refunding $140 million to consumers, $120 million of which is for surprise overdraft fees and double dipping on non sufficient funds fees.

Overdraft Examples Fees Explained Awesomefintech Blog The cfpb issued guidance to rein in surprise overdraft fees in october 2022. it also took enforcement actions against wells fargo, regions bank, and atlantic union to return to consumers $205 million, $141 million, and $5 million in unlawful fees, respectively, in addition to significant civil money penalties paid to the cfpb’s victims relief. Cfpb is also announcing that it secured an additional $140 million in consumer refunds from companies that charged illegal junk fees, such as surprise overdraft fees and multiple bounced check. Companies will refund $ 140 mil‐ lion to consumers following consumer financial protection bureau reporting on illegal junk fees. surprise bank overdraft and nonsufficient fund fees account for $ 120 million of the amount. nearly two thirds of banks with more than $ 10 billion in assets have dropped nsf fees, accord‐ ing to a separate report. These refunds of these fees make up $120 million of the total of $140 million included in the announcement. are related to surprise overdraft and nsf fees, the report also highlighted other.

:max_bytes(150000):strip_icc()/overdraft-4191679-FINAL-ced43d559c6e4b909fe775200cb5acc3.png)

Overdraft Explained Fees Protection And Types Companies will refund $ 140 mil‐ lion to consumers following consumer financial protection bureau reporting on illegal junk fees. surprise bank overdraft and nonsufficient fund fees account for $ 120 million of the amount. nearly two thirds of banks with more than $ 10 billion in assets have dropped nsf fees, accord‐ ing to a separate report. These refunds of these fees make up $120 million of the total of $140 million included in the announcement. are related to surprise overdraft and nsf fees, the report also highlighted other. The consumer financial protection bureau's monitoring of illegal junk fees will result in a $140 million payday for consumers, according to a report. In 2019, overdraft, bounced check and non sufficient funds fees generated roughly $15 billion for banks, according to the cfpb. the regulator's new enforcement push against these junk fees could.

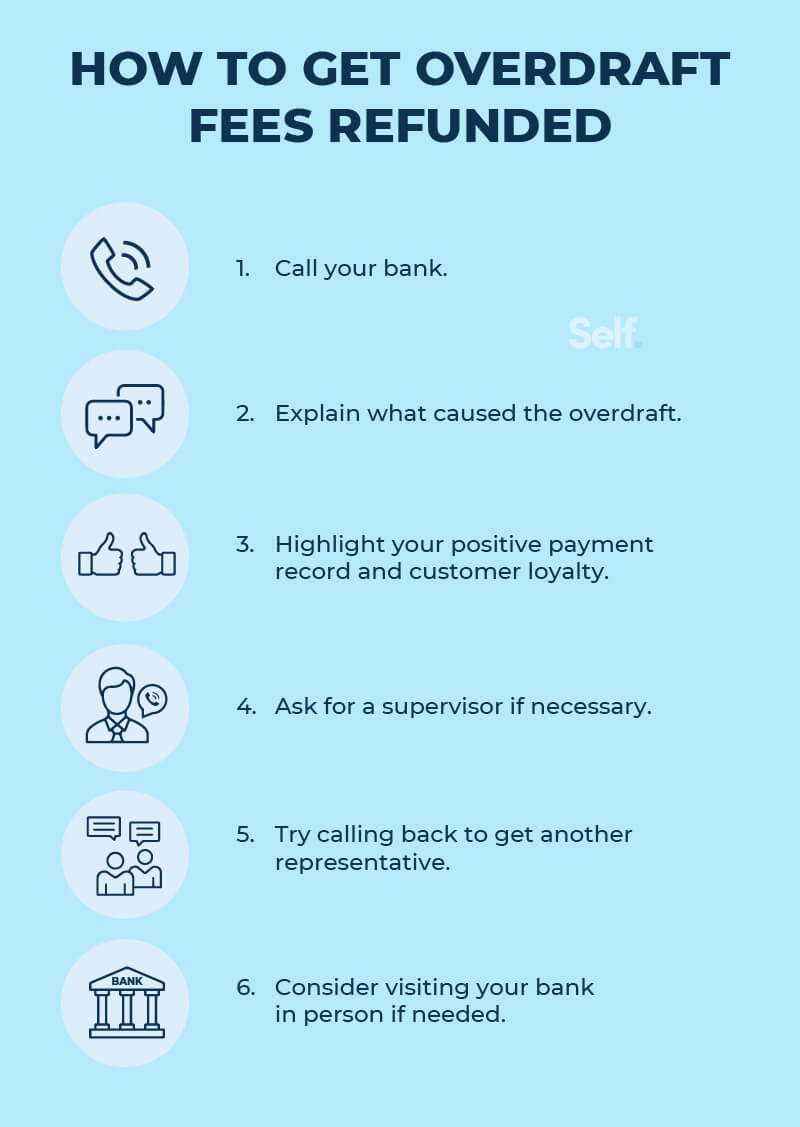

How To Get Overdraft Fees Refunded Self Credit Builder The consumer financial protection bureau's monitoring of illegal junk fees will result in a $140 million payday for consumers, according to a report. In 2019, overdraft, bounced check and non sufficient funds fees generated roughly $15 billion for banks, according to the cfpb. the regulator's new enforcement push against these junk fees could.

Comments are closed.