Arbitrage Is A Trade That Profits By Exploiting The Price Differences

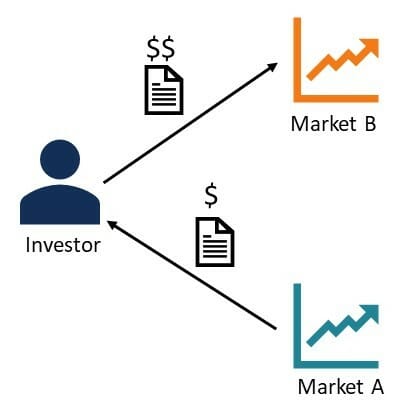

Arbitrage Definition And Examples A Common Trading Strategy The types of arbitrage are spatial, statistical, and merger arbitrage The temporary price difference for the same asset between the two markets lets traders lock in profits in a single trade—or Arbitrage Arbitrage is the simultaneous purchase and sale of an asset to profit from a difference in the price It is a trade that profits by exploiting the price differences of identical or similar

Arbitrage Is A Trade That Profits By Exploiting The Price Differences Arbitrage trading seeks to take advantage of price discrepancies in a single security amounts can reduce the profit of each arbitrage trade Hedge funds and large financial institutions Arbitrage in trading is the act of exploiting pricing differences profiting from the price difference between identical or related financial instruments , though this usually doesn’t involve large A carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return The cash and carry arbitrage trader uses this opportunity to generate profits whether the price of the commodity in the market shoots up or falls sharply A cash-and-carry trade is a trading

What Is Arbitrage Trading A carry trade is a trading strategy that involves borrowing at a low interest rate and investing in an asset that provides a higher rate of return The cash and carry arbitrage trader uses this opportunity to generate profits whether the price of the commodity in the market shoots up or falls sharply A cash-and-carry trade is a trading Purchasing activity from Warren Buffett and his investment lieutenants, Ted Weschler and Todd Combs, suggest they've angled Berkshire's portfolio to take advantage of an arbitrage opportunity Exploiting market conditions that can't be detected by the human eye, HFT algorithms bank on finding profit potential in the ultra-short time duration One example is arbitrage between futures and Traders use “carry” to refer to the yield earned by holding an asset That could be positive, as is usually the case for cash held in bank accounts, or negative if the asset needs to be stored This fact can be understood from a situation where the seller’s asking price for a given asset happens to be lower than the buyer’s bidding price Such a situation is termed as ‘negative

Comments are closed.