An Overview Of Mutual Fund Types Risks And Advantages A Guide To

An Overview Of Mutual Fund Types Risks And Advantages A Guide To Mutual funds come with many advantages, such as advanced portfolio management, dividend reinvestment, risk reduction, convenience, and fair pricing. disadvantages include high fees, tax. Guide to mutual funds; mutual funds. learn about the different types of mutual funds, what they cost, how they work, how they’re taxed, and more. mutual funds: advantages and disadvantages.

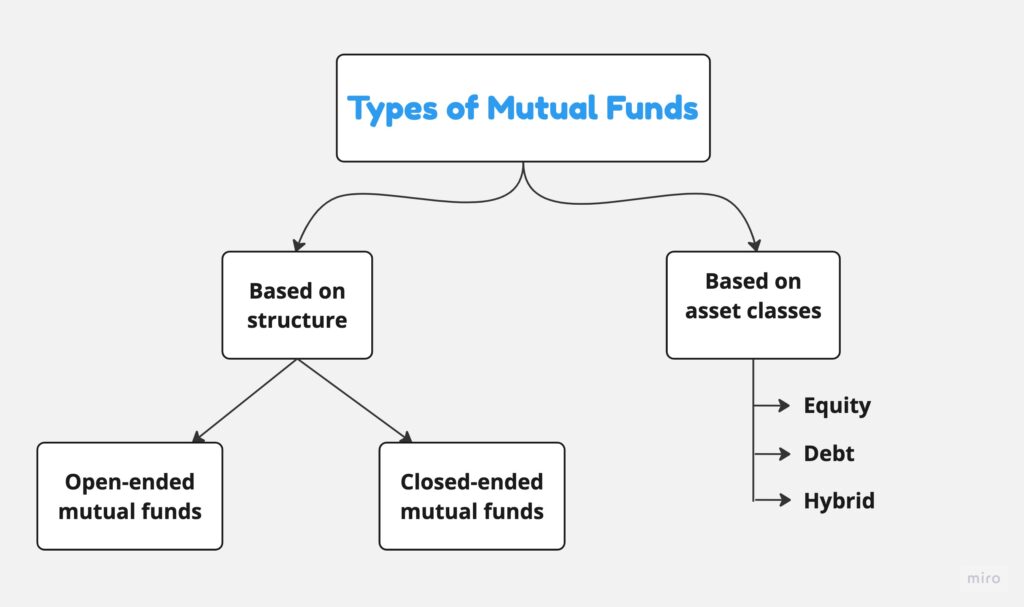

Mutual Fund Meaning Types Advantages Key Terms And More How to invest in mutual funds. a beginner’s guide to mutual fund investing what types of mutual funds best align with my goals and risk tolerance (e.g., equity, bond, and balanced funds. A mutual fund is a portfolio of investments that pools money from investors to purchase multiple securities. some mutual funds are actively managed with the aim to outperform the market. mutual. Advantages and disadvantages of different mutual fund types. equity funds offer growth potential and diversification but come with higher market risk and fees. fixed income funds provide stable income and lower risk, yet they face interest rate and credit risks, offering lower growth potential. index funds are low cost and track market indices. Mutual funds use money from investors to purchase stocks, bonds and other assets. you can think of them as ready made portfolios, and with their diverse holdings, mutual funds can help you diversify your own portfolio more easily. 1 as the fund's investments gain or lose value, you gain or lose as well, and when they pay dividends.

Comments are closed.