A Complete Guide On Mutual Fund Investment Wint Wealth

A Complete Guide On Mutual Fund Investment Wint Wealth The net asset value of a mutual fund scheme is the total market value of a fund’s assets minus its liabilities. the nav of a scheme depicts its unit price, i.e., the amount you pay to buy one unit of the scheme. for example, if the nav of a scheme is rs. 45, and you wish to buy 10 units, you will have to invest ₹450. Step 1: create an account on your preferred mutual fund investment platform by completing the kyc process and providing the required information like bank details, address proof etc. step 2: choose your choice of mutual fund for investing. step 3: select a payment mode sip or lump sum.

Amazon Mutual Funds Investing 101 A Beginner S Guide To Building If you are interested in investing in us stocks mutual funds in india, then we have curated a list of the top 10 funds based on their past performance. name of the us equity stocks mutual fund. 3 years annualised returns. 5 years annualised returns. motilal oswal nasdaq 100 etf (most shares nasdaq 100). A mutual fund pools money from a set of different investors in order to invest in a portfolio of asset classes like stocks and bonds. unlike the stock market, in which investors purchase shares from one another, mutual fund shares are purchased directly from the fund or a broker who purchases shares for investors. How to invest in mutual funds, step by step. 1. set your investment goals and budget. as with any investment, it’s important to set clear goals that align with your broader financial objectives. A mutual fund is an investment vehicle which pools money from multiple investors. the collective funds are then invested in various assets such as stocks, bonds and other asset classes. while mutual funds have gained immense popularity in recent years, you should remember that all your investments should align with your income, expenditures, risk profile, and financial goals. based on these.

Mutual Fund Investment Mutual Fund Investment How It Works Types How to invest in mutual funds, step by step. 1. set your investment goals and budget. as with any investment, it’s important to set clear goals that align with your broader financial objectives. A mutual fund is an investment vehicle which pools money from multiple investors. the collective funds are then invested in various assets such as stocks, bonds and other asset classes. while mutual funds have gained immense popularity in recent years, you should remember that all your investments should align with your income, expenditures, risk profile, and financial goals. based on these. Wint wealth is a fixed income platform where you can invest in products that give you better returns than fds and debt mutual funds but are less risky than s. Final word. ltcg tax on equity mutual funds is lower than the tax on short term capital gains (stcg) at a rate of 15%, making long term investments more tax efficient. the ltcg tax is applicable only when the gains exceed rs 1 lakh, which provides relief to small investors. the introduction of the grandfathering clause has provided a tax relief.

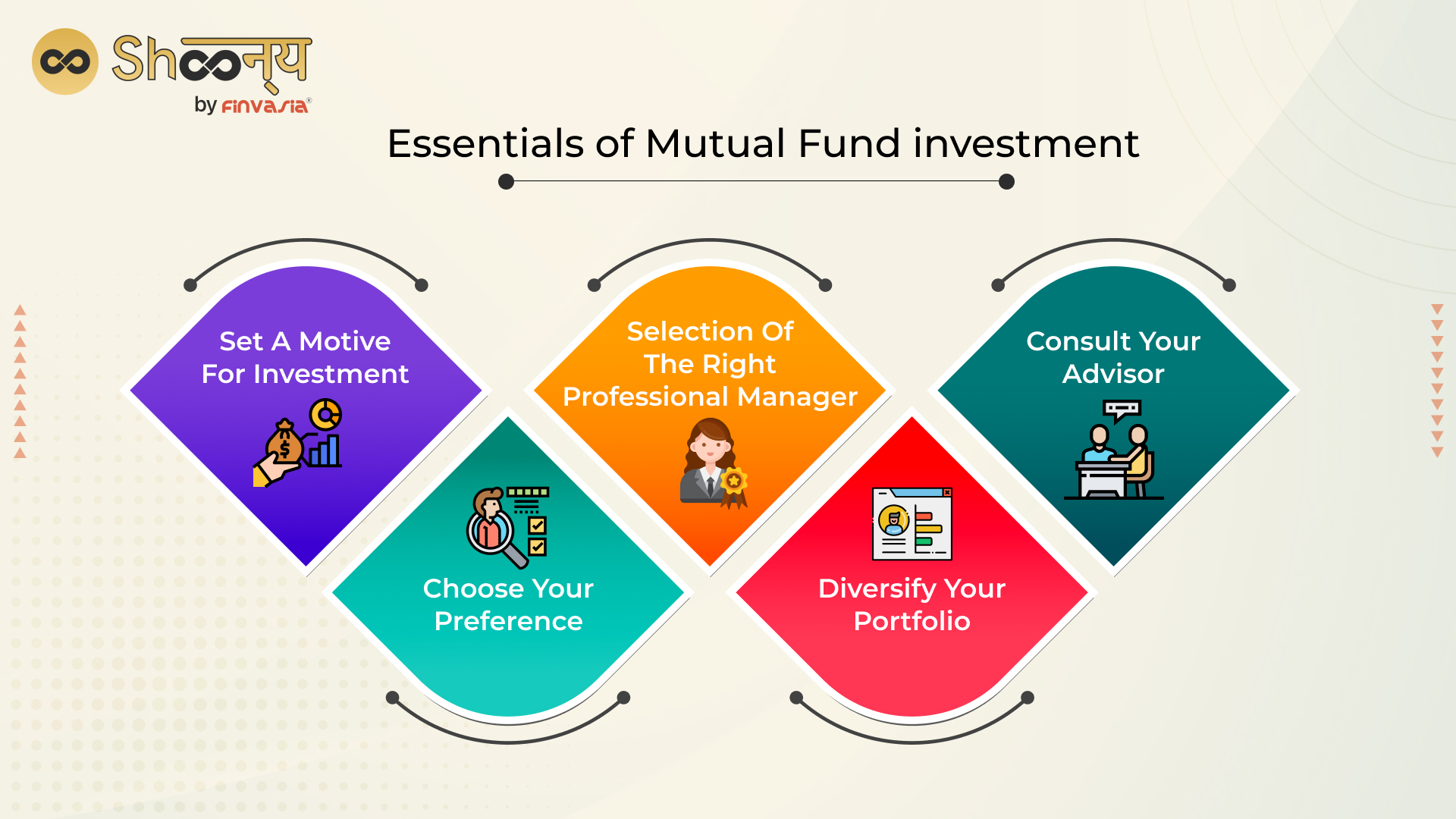

How To Invest In Mutual Funds Online A Complete Guide Shoonya Blog Wint wealth is a fixed income platform where you can invest in products that give you better returns than fds and debt mutual funds but are less risky than s. Final word. ltcg tax on equity mutual funds is lower than the tax on short term capital gains (stcg) at a rate of 15%, making long term investments more tax efficient. the ltcg tax is applicable only when the gains exceed rs 1 lakh, which provides relief to small investors. the introduction of the grandfathering clause has provided a tax relief.

Comments are closed.