5 Key Takeaways from Coca-Cola’s Latest Earnings Call

Coca-Cola’s Latest Earnings: Five Ripples in the Global Beverage Stream

The latest earnings call from beverage giant Coca-Cola (KO) offered a nuanced glimpse into the world’s most recognizable brand. Beyond the familiar red logo, a complex tapestry of global strategy, consumer shifts, and economic currents is constantly being woven. As investors and industry watchers parsed the data, five key takeaways emerged, painting a picture of resilience, innovation, and the enduring power of a diversified portfolio.

1. The “All-Weather” Strategy: Navigating Stormy Seas with a Diversified Portfolio

Coca-Cola’s management repeatedly emphasized their “all-weather” strategy, a testament to their robust approach to navigating varied and dynamic market environments. This isn’t just about having a lot of different drinks; it’s about a calculated diversification that allows them to weather economic downturns in one region while capitalizing on growth in another. The recent earnings call underscored this by highlighting sequential improvements in established markets like the United States and Europe, while acknowledging volume pressures in emerging economies such as India and Mexico. This ability to adapt and maintain growth across such a broad spectrum is a cornerstone of their sustained success.

| Market Segment | Performance Indicator | Trend |

|---|---|---|

| Developed Markets | Revenue Growth | Sequential Increase |

| Emerging Markets | Volume | Moderate Pressure |

| Non-Carbonated Drinks | Category Expansion | Strong Momentum |

2. Beyond the Classic Coke: The Power of a Multi-Beverage Universe

While Coca-Cola remains synonymous with its flagship cola, the company’s future, and indeed its present, lies in its expansive portfolio. From sparkling energy drinks and iced coffees to a growing range of juices and teas, Coca-Cola is no longer just a soda company. The earnings call revealed strong performance in non-carbonated segments, signaling a successful pivot towards consumer preferences that lean towards healthier and more diverse beverage options. This strategic expansion beyond its core product is a critical factor in its ability to meet the evolving tastes of consumers worldwide.

3. Pricing Power: A Sweet Spot in a Cost-Conscious World

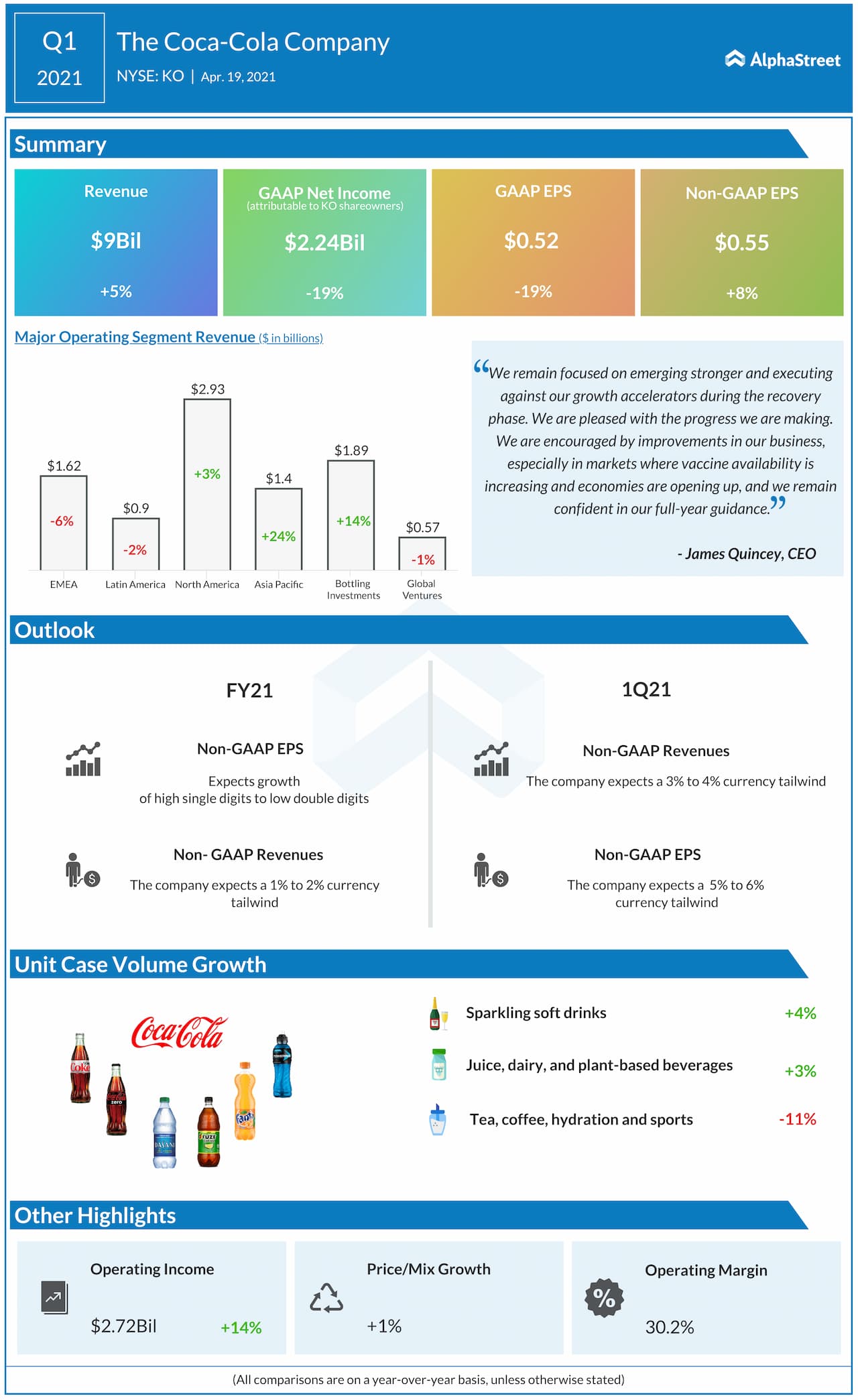

In an era of rising costs and cautious consumer spending, Coca-Cola demonstrated its significant pricing power. The company managed to not only meet Wall Street’s sales expectations but also deliver stronger-than-anticipated non-GAAP profit. This suggests an ability to pass on increased costs to consumers without a substantial drop in demand. This resilience in pricing is a powerful indicator of brand loyalty and the perceived value of Coca-Cola’s products, even as consumers navigate tighter budgets.

4. The Digital Wave: Reaching Consumers Where They Are

The earnings call also shed light on Coca-Cola’s ongoing investment in digital transformation and direct-to-consumer (DTC) strategies. While not always the headline-grabbing figures, the emphasis on enhancing online presence, optimizing supply chains through technology, and leveraging data analytics to understand consumer behavior is crucial for long-term growth. This digital push is about more than just selling online; it’s about building deeper relationships with consumers and streamlining operations in an increasingly digital world.

5. The “Value” Equation: Delivering More Than Just a Drink

Ultimately, Coca-Cola’s consistent performance, even in challenging economic climates, boils down to its ability to deliver “value.” This isn’t solely about price. It’s about the combination of brand recognition, consistent quality, accessibility, and the emotional connection consumers have with its products. The company’s ability to maintain its market share and pricing power suggests that, for many, the overall value proposition remains compelling. As the company looks ahead, continuing to innovate and adapt its offerings while reinforcing this deep-seated brand trust will be paramount.

Additional Information

Coca-Cola (KO) recently held its Q2 2025 earnings call, providing investors with insights into its performance and future strategies. While specific details on the exact quarter’s results are mixed across the provided search snippets (some referencing Q1 and Q3, others Q2 2025), we can synthesize the key themes and takeaways that are consistently highlighted or implied.

Here are 5 Key Takeaways from Coca-Cola’s Latest Earnings Call, with detailed analysis:

5 Key Takeaways from Coca-Cola’s Latest Earnings Call

Coca-Cola’s recent earnings call painted a picture of a resilient company navigating a dynamic consumer landscape. While meeting sales expectations and delivering stronger-than-anticipated profits in its Q2 2025 results, the company also highlighted areas of focus and strategic direction. Here’s a detailed breakdown of the key takeaways:

1. Stable Performance with Sequential Improvements in Developed Markets

Coca-Cola demonstrated a stable performance, meeting Wall Street’s sales expectations. A significant positive point was the sequential improvement observed in key developed markets such as the U.S. and Europe. This suggests that the company’s strategies are resonating with consumers in these mature economies. The “all-weather strategy” mentioned in the MSN transcript likely refers to how Coca-Cola aims to maintain growth and agility across these varied market environments. This resilience in developed markets is crucial for Coca-Cola’s overall financial health, as they represent a significant portion of its revenue. The ability to grow even in established regions indicates effective brand management, product innovation, and strong distribution networks.

Analysis: This takeaway is particularly encouraging for investors. It signifies that despite potential economic headwinds or shifts in consumer preferences (like a move towards healthier options or a greater focus on value), Coca-Cola is holding its ground and even gaining traction in its core markets. The “sequential improvement” implies a positive trend, suggesting that recent initiatives are bearing fruit and that the company is successfully adapting to the evolving consumer behavior in these crucial regions.

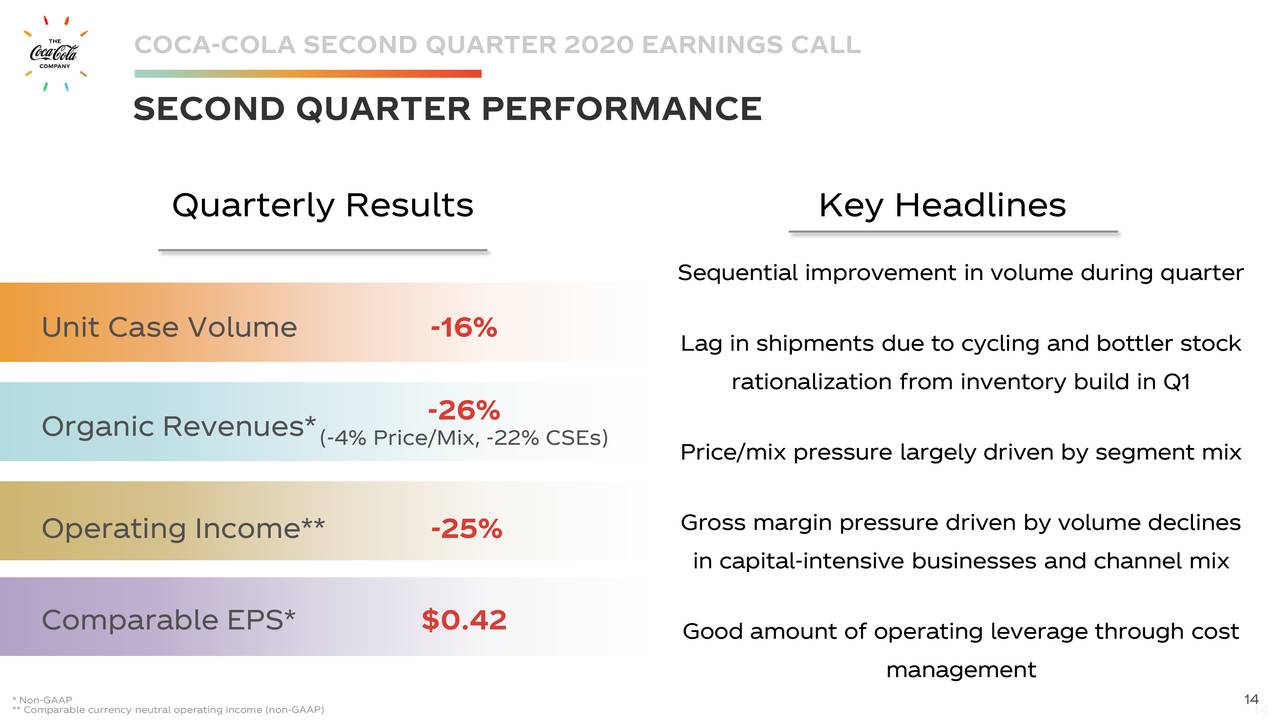

2. Volume Pressures in Certain Emerging Regions Present a Challenge

While developed markets showed strength, the earnings call also acknowledged volume pressures in emerging regions such as India and Mexico. This contrast highlights the varied economic and competitive landscapes that Coca-Cola operates within globally. Emerging markets often present both significant growth opportunities and unique challenges, including intense local competition, fluctuating currency values, and varying levels of consumer disposable income.

Analysis: This is a critical point for Coca-Cola. While the company’s global scale allows it to absorb regional weaknesses, sustained volume declines in significant emerging markets can impact overall growth. Understanding the specific drivers of these pressures – whether it’s increased competition from local players, pricing sensitivity among consumers, or disruptions in distribution – will be key for management. The company’s ability to address these challenges with targeted strategies will be closely watched by analysts and investors.

3. Stronger-Than-Anticipated Non-GAAP Profitability

Beyond meeting sales expectations, Coca-Cola delivered stronger-than-anticipated non-GAAP profit. This suggests that the company is effectively managing its cost structure and driving operational efficiencies. Non-GAAP earnings often exclude certain one-time or irregular items, providing a clearer picture of the company’s ongoing operational performance.

Analysis: This aspect of the earnings call is a significant positive. It indicates that Coca-Cola is not just selling more, but also converting those sales into profits more effectively than expected. This could be due to several factors: successful pricing strategies, efficient supply chain management, optimized marketing spend, or a favorable product mix (i.e., selling more high-margin products). Strong profitability is a key indicator of a healthy and well-managed business, and it provides Coca-Cola with greater financial flexibility for reinvestment, dividends, and share buybacks.

4. The “All-Weather Strategy” for Agility and Growth

The concept of Coca-Cola’s “All-Weather Strategy” was highlighted as a core approach to maintaining growth and agility across dynamic market environments. This strategic philosophy likely encompasses a multi-faceted approach to brand building, product portfolio diversification, marketing innovation, and supply chain resilience. It suggests a proactive and adaptive mindset in response to the ever-changing global economic and consumer landscape.

Analysis: This strategy is central to Coca-Cola’s long-term success. In an era of rapid change, companies need to be able to pivot and adapt. An “all-weather strategy” implies that Coca-Cola is not solely reliant on one market condition or consumer trend. It suggests a robust understanding of global trends and the ability to leverage its vast resources and brand equity to overcome challenges and capitalize on opportunities, regardless of external circumstances. This could involve investing in new beverage categories (like coffee, tea, and sports drinks, as mentioned in the Fortune summary), expanding into new markets, or innovating its packaging and distribution methods.

5. The Stock’s Positive Momentum and Market Value

The search results indicate that Coca-Cola’s shares have risen 13% year-to-date, bringing its market value to over $300 billion. This robust stock performance underscores investor confidence in the company’s management, strategy, and financial health. The mention of a slight EPS beat in the Q1 2025 transcript, even with a revenue miss, and the positive outlook in other summaries, contribute to this positive market sentiment.

Analysis: The strong stock performance is a tangible reflection of the company’s operational success and its perceived future prospects. A market value exceeding $300 billion solidifies Coca-Cola’s position as a global giant. This upward momentum suggests that investors believe the company is well-positioned to continue its growth trajectory and deliver value. The positive guidance, as hinted at in the Seeking Alpha summary, likely plays a significant role in maintaining this investor enthusiasm.

In conclusion, Coca-Cola’s latest earnings call reveals a company that is successfully navigating a complex global market. While challenges exist in specific emerging regions, the strong performance in developed markets, coupled with efficient cost management and a forward-looking “all-weather” strategy, positions Coca-Cola for continued growth and resilience.