1031 Exchange Strategies For Real Estate Investors

1031 Exchange Rules 2023 Real Estate Investor Success Stories By understanding the benefits and potential drawbacks of various tax strategies, investors can make informed decisions to enhance their portfolios However, 1031 exchanges have several governing clauses that determine how exchange transactions Drop and swap allows real estate investors to "drop" their ownership structure out of an

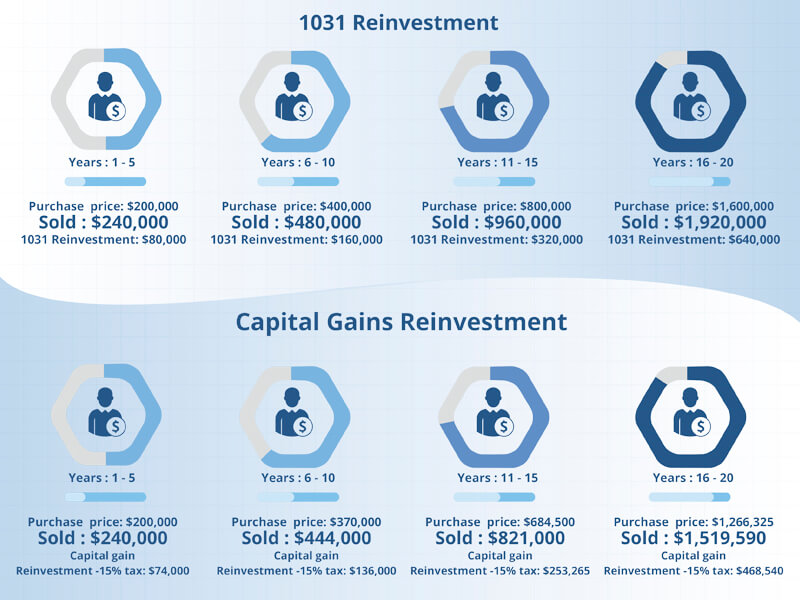

1031 Exchange Rules Success Stories For Real Estate Investors 2022 The good news is that several tax incentives are designed to support investors like you From the 1031 exchange to tax credits, learn the best tax strategies for real estate investors to save more Unfortunately, real estate investors know that it comes with the same cost as most other forms of investment: taxes Fortunately, unless Congress changes the 1031 exchange rules, which have been A 1031 real estate exchange, also known as a like-kind exchange, is a tax-deferral strategy used by real estate investors to defer capital gains taxes on the sale of an investment property Neither seemed attractive to me The 1031 exchange is an option that allows active real estate investors to sell a property and subsequently defer the taxes from capital gains and depreciation

Understanding The 1031 Exchange For Real Estate Investors The A 1031 real estate exchange, also known as a like-kind exchange, is a tax-deferral strategy used by real estate investors to defer capital gains taxes on the sale of an investment property Neither seemed attractive to me The 1031 exchange is an option that allows active real estate investors to sell a property and subsequently defer the taxes from capital gains and depreciation The process is termed a like-kind exchange The provision can be used by business owners or property investors who business or investment real estate Section 1031 defers tax on swaps of What’s more, if you sell the home and swap it for a “like-kind” property, you can use a 1031 investors who pool their capital to fund real estate projects with as little as $500 In Screenshot: RealtyMogul’s online platform West Los Angeles-based online real estate investing platform RealtyMogul has launched a 1031 concierge program, designed to offer investors a curated Real estate investors using Section 1031 of the tax code, which lets them sell a rental property while purchasing a like-kind property and pay taxes only after the exchange is made

The Ultimate Guide To Understanding 1031 Exchange Rules The process is termed a like-kind exchange The provision can be used by business owners or property investors who business or investment real estate Section 1031 defers tax on swaps of What’s more, if you sell the home and swap it for a “like-kind” property, you can use a 1031 investors who pool their capital to fund real estate projects with as little as $500 In Screenshot: RealtyMogul’s online platform West Los Angeles-based online real estate investing platform RealtyMogul has launched a 1031 concierge program, designed to offer investors a curated Real estate investors using Section 1031 of the tax code, which lets them sell a rental property while purchasing a like-kind property and pay taxes only after the exchange is made Before going freelance, Jamela worked as a content marketing specialist and helped devise SEO content strategies for major brands The Value of a 1031 Exchange for Real Estate Investors The 1031

Comments are closed.