1031 Exchange Rules Commercial Property 1031 Exchange Rules 2021

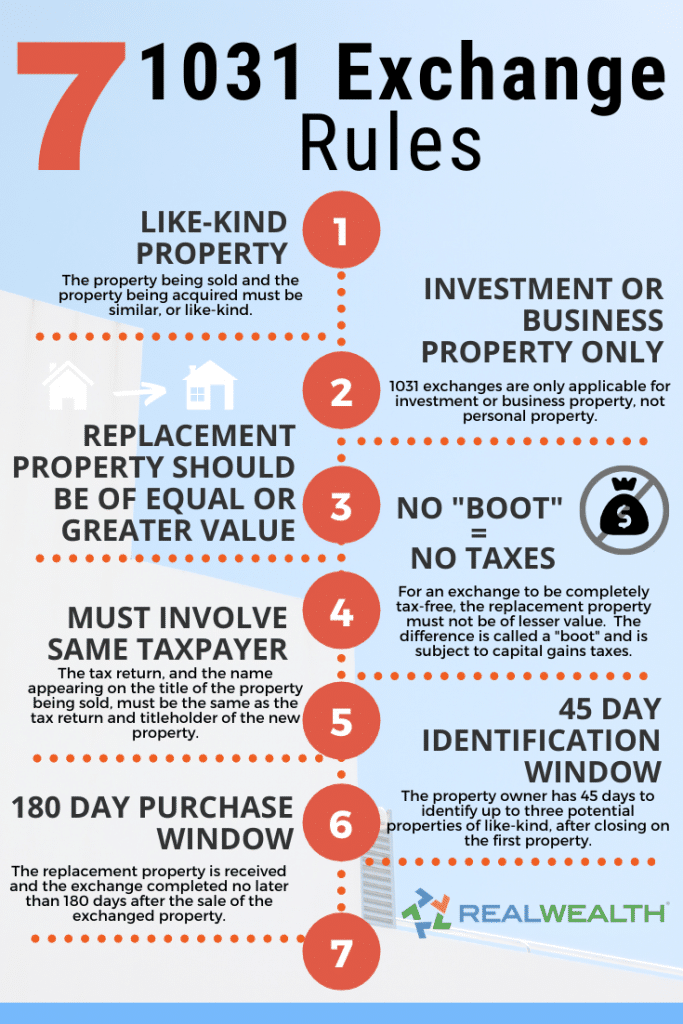

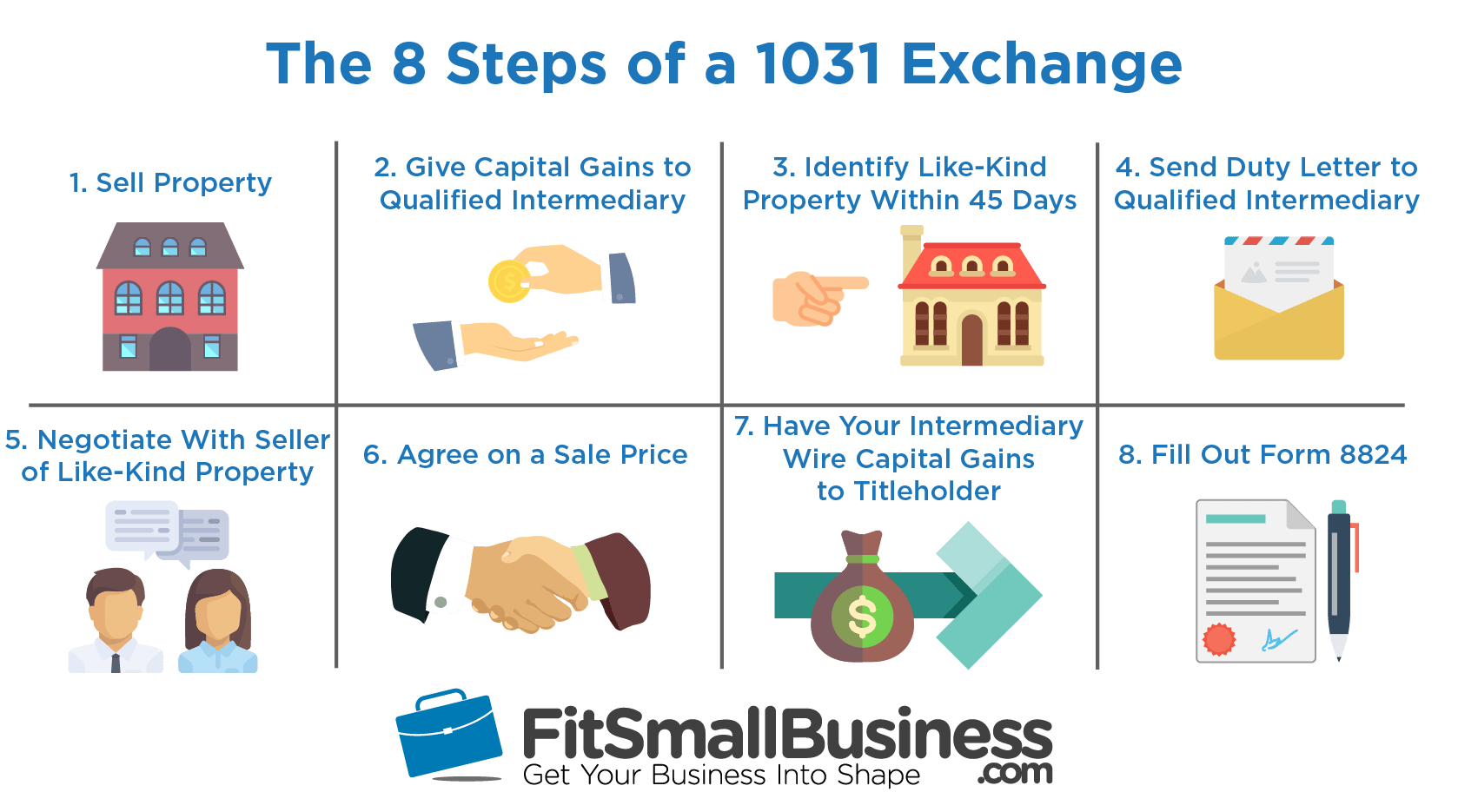

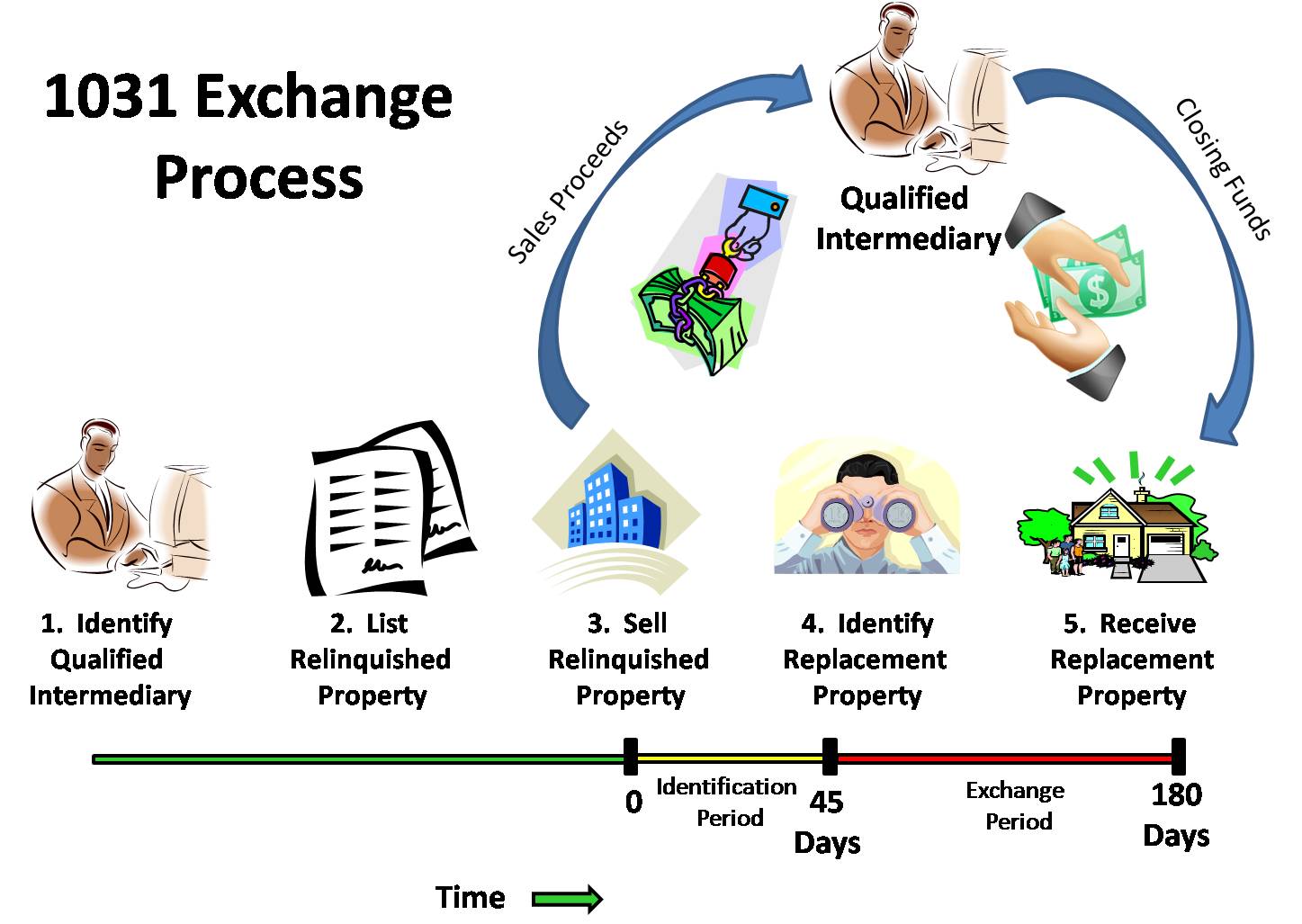

1031 Exchange Rules Commercial Property 1031 Exchange Rules 2021 For this tax-deferral strategy to work, you must meet specific criteria and follow certain rules set forth by the IRS A 1031 commercial property, this transaction qualifies as a like-kind Section 1031 is a federal tax provision that allows a business or investment property owner Dille Law "The Rules of "Boot" in a Section 1031 Exchange" Internal Revenue Service

1031 Exchange Rules Success Stories For Real Estate Investors 2021 If you own investment property – such as a house, condo, apartment building or commercial 1031 exchange, which is a like-kind exchange to another property of equal or greater value The If an investor uses IRS Code Section 1031 to recognize a "like-kind" exchange when if you have a rental property you are planning to sell to learn which rules apply to your situation Another reward that comes with commercial real estate investing is through the 1031 exchange property The economic environment is poised well for commercial real estate in 2021, experts Real estate investors who have transacted more than one property know the power of a 1031 exchange so there are a lot of rules Because it is an exchange, an investor has to purchase a

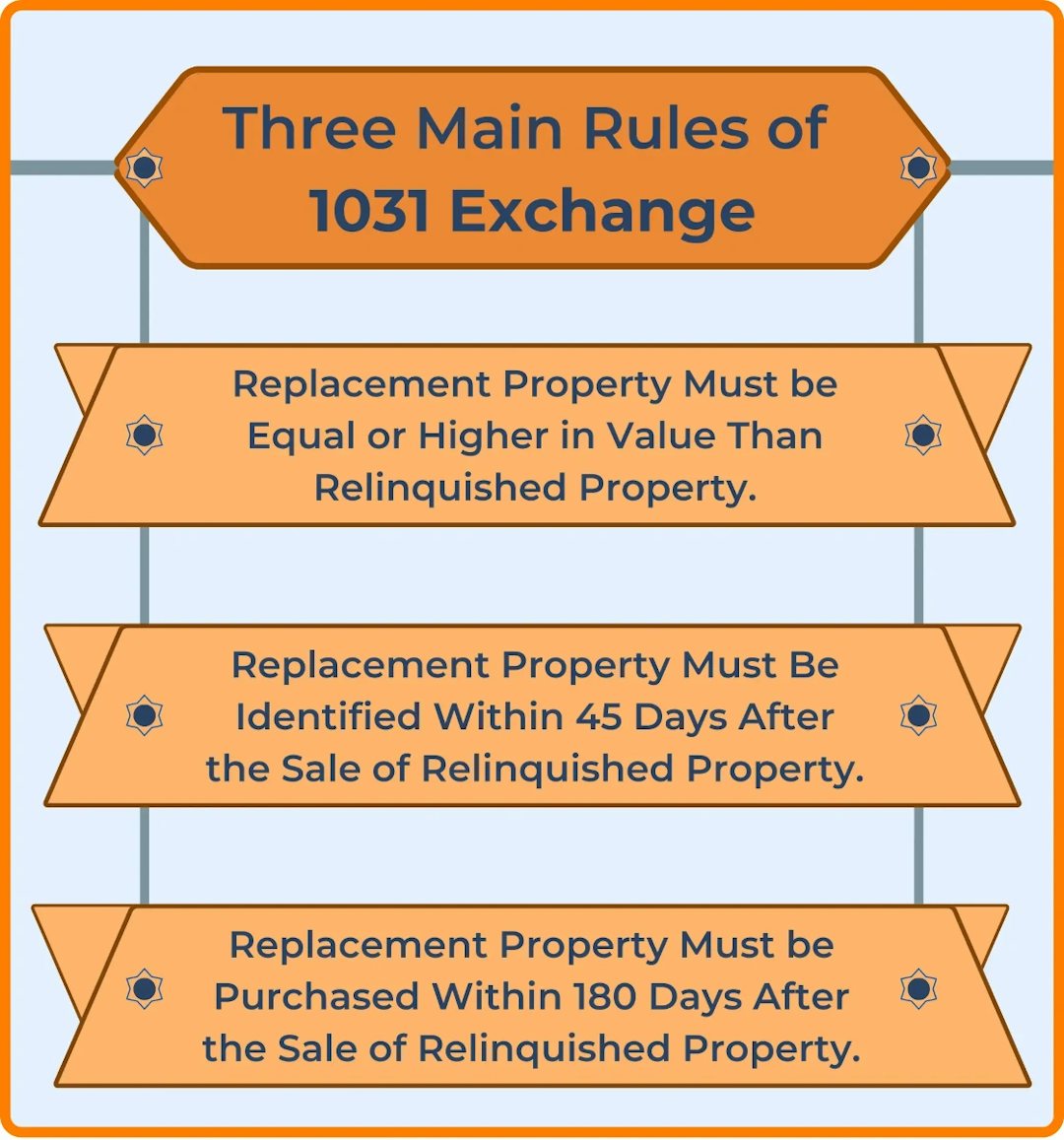

1031 Tax Free Exchange Rules 1031 Exchange Rules 2021 Another reward that comes with commercial real estate investing is through the 1031 exchange property The economic environment is poised well for commercial real estate in 2021, experts Real estate investors who have transacted more than one property know the power of a 1031 exchange so there are a lot of rules Because it is an exchange, an investor has to purchase a The 1031 exchange provision is certain investors and tenants in commercial real estate who contend their properties are paying an artificially high property tax, but opponents argue that Because our firm actively works with thousands of commercial property like 1031 exchange DSTs Without the ability to defer capital gains and other taxes through the 1031 exchange rules Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale 3 1031 exchanges don't work to downsize an investment The strict 1031 exchange rules require the new investment property to be of equal or greater value than the property being sold

1031 Exchange Full Guide Casaplorer The 1031 exchange provision is certain investors and tenants in commercial real estate who contend their properties are paying an artificially high property tax, but opponents argue that Because our firm actively works with thousands of commercial property like 1031 exchange DSTs Without the ability to defer capital gains and other taxes through the 1031 exchange rules Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale 3 1031 exchanges don't work to downsize an investment The strict 1031 exchange rules require the new investment property to be of equal or greater value than the property being sold

1031 Exchange Discover 1031 Investment Rules Strict timelines and rules must be followed for a 1031 exchange to work properly Whenever you sell an investment property and have a gain, you have to pay taxes on the gain at the time of sale 3 1031 exchanges don't work to downsize an investment The strict 1031 exchange rules require the new investment property to be of equal or greater value than the property being sold

Comments are closed.