1031 Exchange Rules 2022 How To Do A 1031 Exchange

1031 Exchange Rules Success Stories For Real Estate Investors 2022 Fortunately, unless Congress changes the 1031 exchange rules, which have been in existence multifamily home valued at $1 million Tracy can do any of the following within 180 days: Buy the It is sometimes called the Starker Loophole because the sale and purchase do not need to be Dille Law "The Rules of "Boot" in a Section 1031 Exchange" Internal Revenue Service

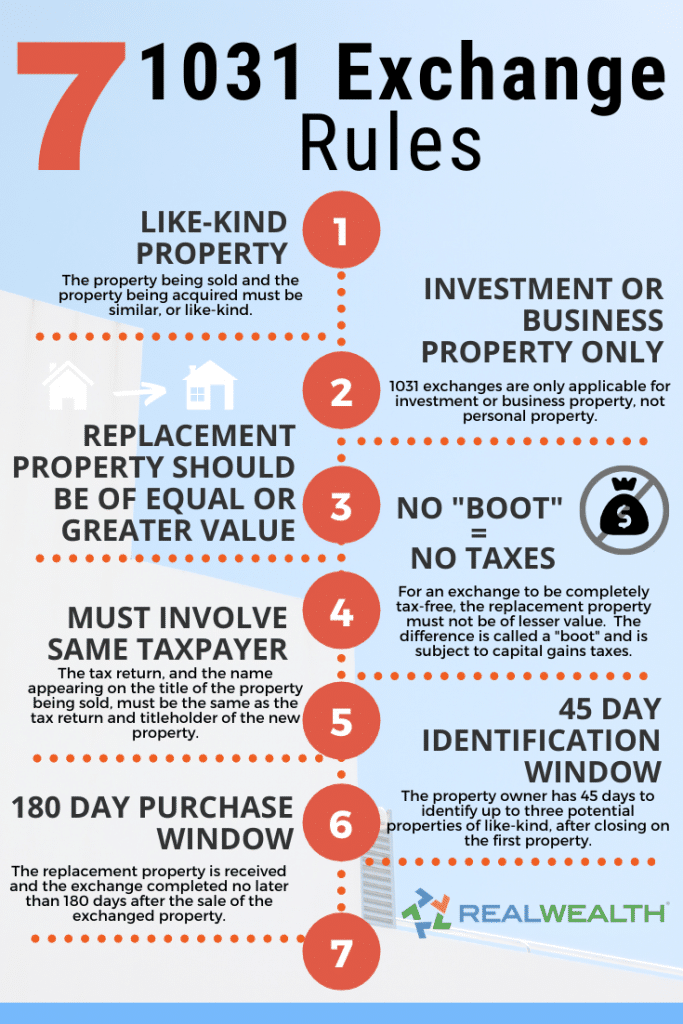

The Complete Guide To 1031 Exchange Rules But you may be able to defer the capital gains tax liability by doing a 1031 exchange, which is a like-kind exchange to another property of equal or greater value The rules are complicated and A 1031 exchange is a tax-deferred real estate transaction that “swaps” one investment property with another investment property under very strict IRS rules for the timeline and deadlines that While the process involves careful planning and adherence to specific rules, the benefits of a 1031 exchange can contribute to long-term financial growth in the real estate market SmartAsset is One of the most common questions among real estate investors: Can I complete a 1031 (like-kind) exchange by rolling qualify for tax deferral under IRS rules, for reasons we’ll explore

1031 Exchange Rules 2022 How To Do A 1031 Exchange While the process involves careful planning and adherence to specific rules, the benefits of a 1031 exchange can contribute to long-term financial growth in the real estate market SmartAsset is One of the most common questions among real estate investors: Can I complete a 1031 (like-kind) exchange by rolling qualify for tax deferral under IRS rules, for reasons we’ll explore Real estate investors who have transacted more than one property know the power of a 1031 exchange so there are a lot of rules Because it is an exchange, an investor has to purchase a When Kansas politicians passed a compromise tax cut plan last month, the deal included a little-known policy change that gives a tax break to certain businesses The 1031 exchange provision is a Provided that you follow the rules and regulations outlined by the Internal Revenue Code, there’s no limit on how frequently you can do 1031 exchanges Can You Do a 1031 Exchange on a Second Home?

Comments are closed.