рџ љ Price Action How To Predict Next Candlestick W Processођ

рџ љ Price Action How To Predict Next Candlestick W Reversal ★★★ become a pro trader! ★★★"binary options are not promoted or sold to retail eea traders. if you are not a professional client, please leave this page."rel. In this video, i would tutor you on how to predict the next candlestick using candlestick psychology and pure price action, to help you make consistent profi.

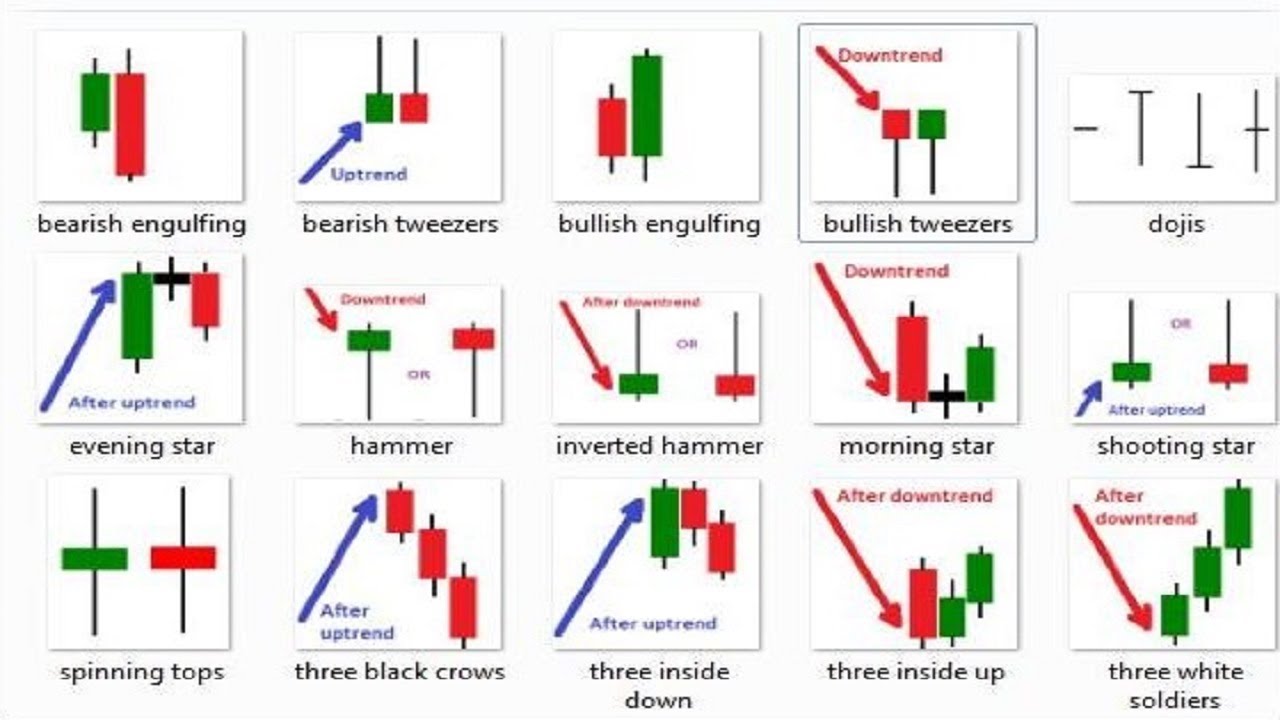

рџ љ Price Action How To Predict Next Candlestick W Support And Prediction period = 1 # assuming next candlestick is 1 time unit away. prediction frequency = dominant frequency * prediction period. next candlestick prediction = np.exp(1j * 2 * np.pi. Enter the humble candlestick pattern. these simple formations, like the hammer, shooting star, and doji, give us a peek into the minds of traders, offering clues about where the price might be headed. but let’s face it, there are a ton of patterns out there. remembering them all can feel like an impossible task. It indicates that while there has been selling pressure during the trading timeframe, buyers are now driving the price up. this usually signals that the next candlestick could be a green one. 3. inverted hammer. this is similar to the previous pattern, except that the upper wick is the one that is long. Opens above the high of the first candlestick; and. closes below the mid point of the first candlestick. due to the first criterion of both patterns, the second bar must open with a gap away from the close of the first bar. hence, these candlestick patterns are unusual in intraday time frames where gaps are uncommon.

Candlestick Patterns Explained With Examples Need To Know It indicates that while there has been selling pressure during the trading timeframe, buyers are now driving the price up. this usually signals that the next candlestick could be a green one. 3. inverted hammer. this is similar to the previous pattern, except that the upper wick is the one that is long. Opens above the high of the first candlestick; and. closes below the mid point of the first candlestick. due to the first criterion of both patterns, the second bar must open with a gap away from the close of the first bar. hence, these candlestick patterns are unusual in intraday time frames where gaps are uncommon. Candlestick analysis. chart pattern and waves. as long as bullish candlesticks close near the top of the candle. as long as price keeps making higher highs and higher lows. retracements are very short and only consist of a few and or small candlesticks. consolidations are not too deep or just sideways. Candlestick analysis focuses on individual candles, pairs or at most triplets, to read signs on where the market is going. the underlying assumption is that all known information is already reflected in the price. the technique is usually combined with support & resistance. each candle contains information about 4 prices: the high, the low, the.

Candlestick Price Action Trading Pdf вђ Unbrick Id Candlestick analysis. chart pattern and waves. as long as bullish candlesticks close near the top of the candle. as long as price keeps making higher highs and higher lows. retracements are very short and only consist of a few and or small candlesticks. consolidations are not too deep or just sideways. Candlestick analysis focuses on individual candles, pairs or at most triplets, to read signs on where the market is going. the underlying assumption is that all known information is already reflected in the price. the technique is usually combined with support & resistance. each candle contains information about 4 prices: the high, the low, the.

рџ љ Price Action How To Predict Next Candlestick W Candlesti

Comments are closed.