What Is Dollar Cost Averaging Dca Explained How Does Dollar Cost

Dollar Cost Averaging Dca Explained With Examples And 44 Off Dollar cost averaging involves investing the same amount of money in a target security at regular intervals over a certain period, regardless of price. by using dollar cost averaging,. Dollar cost averaging reduces investment risk, and capital is preserved to avoid a market crash. it preserves money, which provides liquidity and flexibility in managing an investment portfolio.

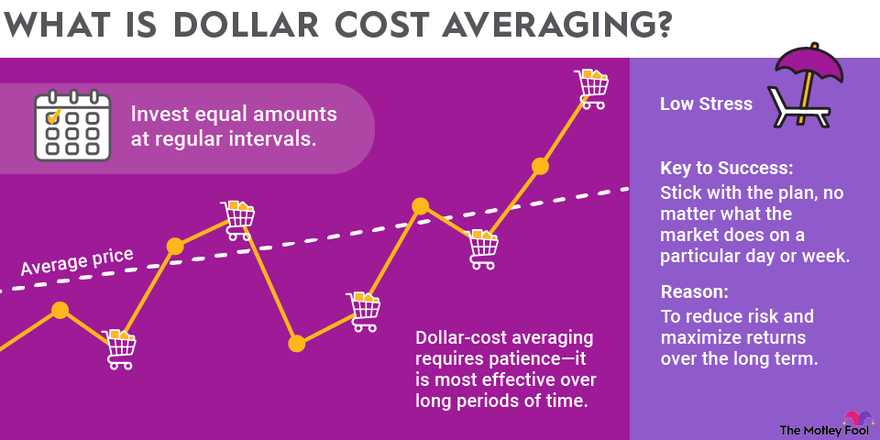

Dca Or Dollar Cost Averaging Explained For Beginners While dollar cost averaging doesn't ensure a profit or protect against loss in declining markets, it's a strategy that some investors use to make regular contributions without trying to "time the market.". Dollar cost averaging is a strategy that can help you lower the amount you pay for investments and minimize risk. over the long term, dollar cost averaging can help lower your investment costs and. Dollar cost averaging (dca) is an investment strategy where rather than investing all the available capital at once, incremental investments are gradually made over time. how does dollar cost averaging work?. • dollar cost averaging (dca) is an investment strategy that helps manage volatility by investing a fixed dollar amount regularly. • dca involves buying securities at regular intervals, regardless of market prices, to avoid trying to time the market.

Dca Dollar Cost Averaging Investment Strategy Explained D Petkovski Dollar cost averaging (dca) is an investment strategy where rather than investing all the available capital at once, incremental investments are gradually made over time. how does dollar cost averaging work?. • dollar cost averaging (dca) is an investment strategy that helps manage volatility by investing a fixed dollar amount regularly. • dca involves buying securities at regular intervals, regardless of market prices, to avoid trying to time the market. Dollar cost averaging is a strategy whereby an investor divides up the amount to be invested across regular purchases in an effort to minimize the impact of volatility on the overall investment. rather than aiming to time the market, they buy in at a range of different prices. Dollar cost averaging (often shortened to dca) is a simple yet effective investment strategy where you put a fixed amount of money into a particular asset or fund at regular intervals—regardless of whether the price is high or low. Dollar cost averaging (dca) presents a straightforward and beginner friendly approach to investing. in this article, we will delve into the definition of dollar cost averaging and explain what it is, how it works, and why it can be an effective investment strategy. let’s get started. Dollar cost averaging (dca) is an investment strategy that aims to apply value investing principles to regular investment. the term was first coined by benjamin graham in his 1949 book the intelligent investor.

Dollar Cost Averaging Dca Explained Tap Global Dollar cost averaging is a strategy whereby an investor divides up the amount to be invested across regular purchases in an effort to minimize the impact of volatility on the overall investment. rather than aiming to time the market, they buy in at a range of different prices. Dollar cost averaging (often shortened to dca) is a simple yet effective investment strategy where you put a fixed amount of money into a particular asset or fund at regular intervals—regardless of whether the price is high or low. Dollar cost averaging (dca) presents a straightforward and beginner friendly approach to investing. in this article, we will delve into the definition of dollar cost averaging and explain what it is, how it works, and why it can be an effective investment strategy. let’s get started. Dollar cost averaging (dca) is an investment strategy that aims to apply value investing principles to regular investment. the term was first coined by benjamin graham in his 1949 book the intelligent investor.

Dollar Cost Averaging Dca Assignment Point Dollar cost averaging (dca) presents a straightforward and beginner friendly approach to investing. in this article, we will delve into the definition of dollar cost averaging and explain what it is, how it works, and why it can be an effective investment strategy. let’s get started. Dollar cost averaging (dca) is an investment strategy that aims to apply value investing principles to regular investment. the term was first coined by benjamin graham in his 1949 book the intelligent investor.

Comments are closed.