Types Of Leverage

Leverage Types Of Leverage And Valuation Concepts Bba Mantra Discover the different types of leverage—financial, operating, and combined—and learn how each impacts business growth and risk management. Learn the definitions, formulas and examples of financial, operating and composite leverages, which are tools to measure the impact of fixed and variable costs on profits. find out how to calculate the degree of leverage and the break even point for different situations.

Leverage Types Of Leverage And Valuation Concepts Bba Mantra There are four main types of leverage: 1. leverage in business. businesses use leverage to launch new projects, finance the purchase of inventory and expand their operations. for many. In finance, leverage is a strategy that companies use to increase assets, cash flows, and returns, though it can also magnify losses. there are two main types of leverage: financial and operating. Learn the definition, types and formula of leverage in financial management. leverage is the ability to use fixed assets or funds to increase the return to equity shareholders, but also involves higher risk and operating costs. Learn about leverage in business, its types (financial and operating), advantages and disadvantages, and how to calculate it. find out how leverage affects earnings, profits, and risks of a company.

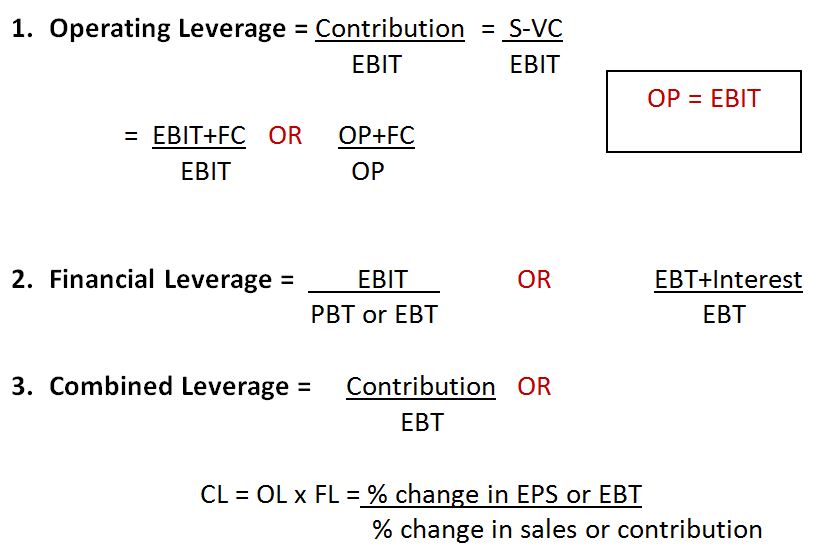

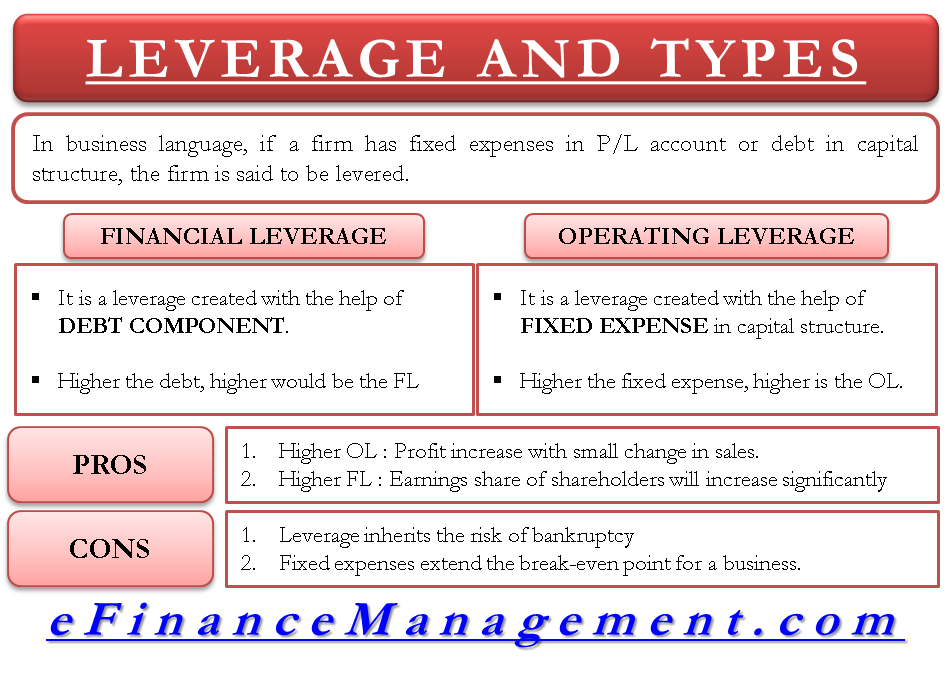

Leverage Types Financial Operating Advantages And Disadvantages Learn the definition, types and formula of leverage in financial management. leverage is the ability to use fixed assets or funds to increase the return to equity shareholders, but also involves higher risk and operating costs. Learn about leverage in business, its types (financial and operating), advantages and disadvantages, and how to calculate it. find out how leverage affects earnings, profits, and risks of a company. Leverage is the use of borrowed money to amplify the results of an investment. companies use leverage to increase the returns of investors' money, and investors can use leverage to invest in various securities; trading with borrowed money is also known as trading on " margin.". Leverage refers to the use of borrowed capital to amplify potential returns or losses on an investment, and it comes with advantages and risks. there are three main types of leverage companies can use: financial leverage, operating leverage, and combined leverage. Understanding how to calculate and properly use leverage is essential for making informed financial decisions and managing investment risk effectively. leverage can be categorized into several types: 1. financial leverage: the use of debt to finance a company's assets. Financial leverage is a tool with which a financial manager can maximise the returns to the equity shareholders. the capital of a company consists of equity, preference, debentures, public deposits and other long term source of funds. he has to carefully select the securities to mobilise the funds.

Comments are closed.