How Do You Tokenize An Asset Cryptobasics360 Com

Tokenize360 How do you tokenize an asset? in this informative video, we will guide you through the process of tokenizing an asset. tokenization is changing how we view o. This article will guide you through the process of how to tokenize an asset in 4 summarized steps. to tokenize an asset, an issuer must first identify the asset representing the tokens created. this asset will serve as the underlying value backing the tokens being issued and transferred to investors.

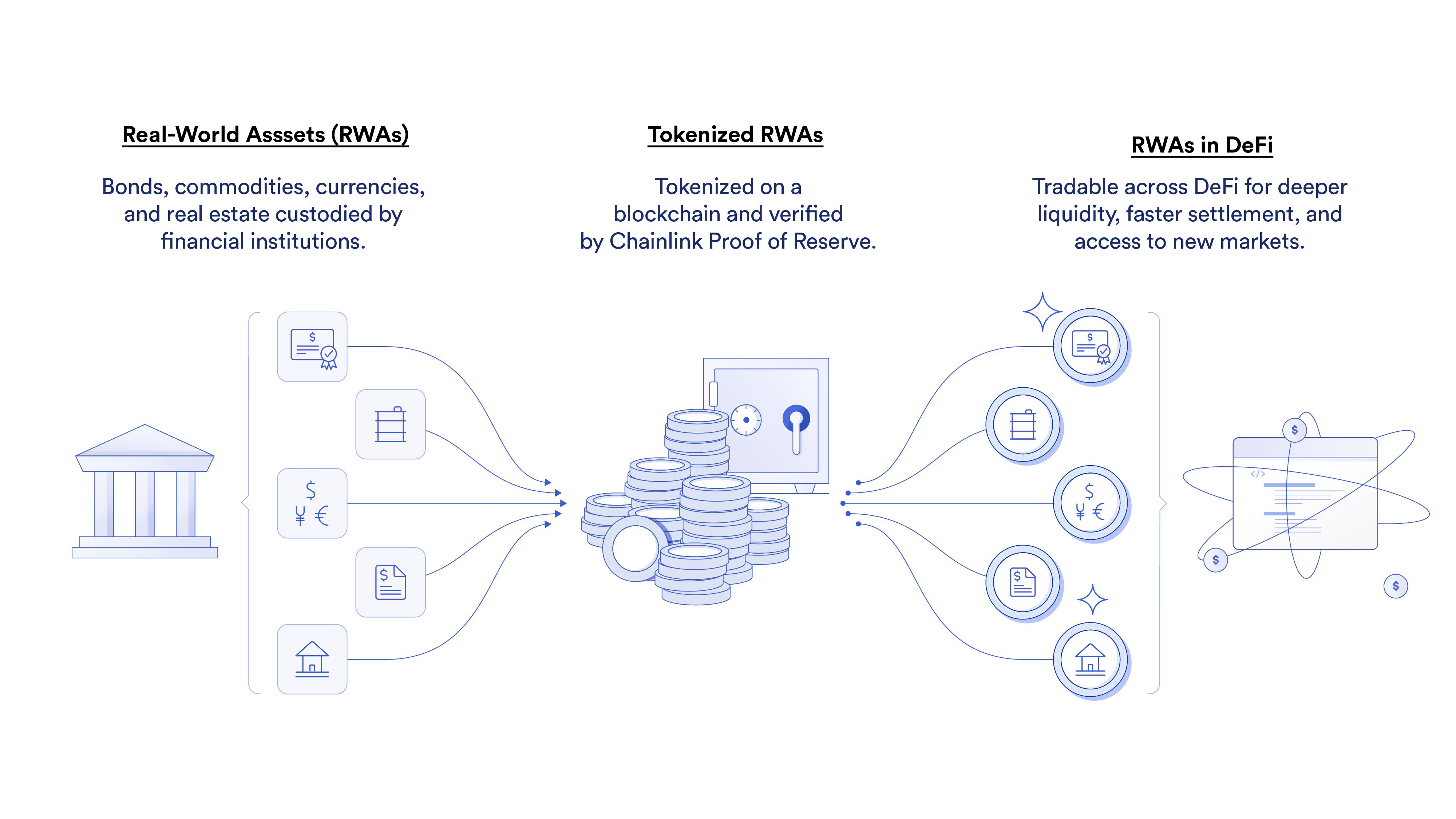

How To Tokenize An Asset Chainlink Asset tokenization refers to turning physical assets, such as real estate, artwork, or commodities, into digital tokens residing on a blockchain. these tokens signify ownership or a share in an. Navigating how to tokenize real world assets involves utilizing security token exchanges like tzero, inx, and securitize, which ensure regulatory compliance for digital asset trading. additionally, defi markets and peer to peer trading platforms offer alternative liquidity solutions. Asset tokenization involves creating digital tokens on a blockchain that represent assets in the real world. tokenization helps convert the ownership rights of an asset—such as fine art or a share in a company—into a digital token that is stored on a blockchain. Asset tokenization involves creating digital tokens on a blockchain that represent assets in the real world. tokenization helps convert the ownership rights of an asset—such as fine art or a share in a company—into a digital token that is stored on a blockchain.

How To Tokenize An Asset Chainlink Asset tokenization involves creating digital tokens on a blockchain that represent assets in the real world. tokenization helps convert the ownership rights of an asset—such as fine art or a share in a company—into a digital token that is stored on a blockchain. Asset tokenization involves creating digital tokens on a blockchain that represent assets in the real world. tokenization helps convert the ownership rights of an asset—such as fine art or a share in a company—into a digital token that is stored on a blockchain. Tokenization involves dividing the asset into smaller units, known as tokens, which can be traded and managed on blockchain networks. the number of tokens to be issued will depend on the asset’s value, and each token will represent a fractional ownership of the underlying asset. This blog will guide you through the concept and process of tokenizing real world assets, providing practical steps and key considerations for leveraging this innovative technology. so, without further ado, let’s get started: what are real world assets?. When you tokenize an asset, you move its ownership onto the blockchain, where the record is permanent and cannot be altered or faked. as a result, tokenization makes it easier, cheaper, and more flexible to own valuable assets. Step 1: start with the off chain asset. you can’t tokenize thin air. there’s got to be something real at the start — a house, a gold bar, a u.s. treasury bond, an invoice from a legit company. that’s the off chain asset. someone has to source it, verify it, and figure out what it’s worth.

Comments are closed.